Aligning Benefits with Costs

Robert Borlick is an energy consultant with more than forty years of experience. He was a partner at Putnam, Hayes & Bartlett, Inc., and Hagler Bailly, Inc. He conducted a number of studies examining state subsidies residential rooftop solar receives and authored a report published by the Consumer Energy Alliance, Incentivizing Solar Energy: An In-Depth Analysis of U.S. Solar Incentives.

Over the past ten years annual installations of rooftop solar PV have soared, partly due to the rapidly declining costs but also due to the generous incentives provided by federal, state, and local governments, and electric utilities.

One of the largest subsidies is provided through Net Energy Metering (NEM), which allows the solar customer to only pay for the net amount of electric energy delivered to the meter, i.e., the amount consumed onsite less that produced by the customer's solar facility.

On first impression NEM sounds reasonable — and it would be if the volumetric energy prices in the tariffs truly reflected the utility's costs of procuring the energy it delivers to the customer's meter — but that is not the case. Just about every residential tariff in the U.S. collects some of the distribution utility's fixed costs through volumetric energy prices. Thus, NEM enables the customer with solar to avoid paying a portion of the utility's fixed costs.

For example, suppose a solar customer produces excess energy during the daylight hours that exactly equals the amount of energy the customer consumes during the night hours. Since the net energy delivered by the utility in that billing period is zero the customer pays nothing. Yet, clearly, the customer has utilized the utility's system to support the two-way energy flows.

To fully comprehend the significance of the NEM subsidy, consider a report published last year by the Consumer Energy Alliance, titled, "Incentivizing Solar Energy: An In-Depth Analysis of U.S. Solar Incentives, 2018 Update." The study estimated the magnitudes of the various incentives provided for residential rooftop solar in twenty-five selected states.

Notably it reveals that the NEM incentive (subsidy) in seven states, Massachusetts, California, Massachusetts, New Jersey, Rhode Island, Connecticut, and Arizona, is greater than the solar customers' net upfront cost of installation after receiving the thirty percent federal tax credit.

In these states, customers with solar save far more through their bill savings than the costs their utilities avoid due to the customers' solar energy production. Someone must make up these revenue losses if the utilities are to earn the rates of return approved by their regulators.

In states employing NEM, the utilities recoup the associated losses by charging higher rates to all residential customers. This causes residential customers without rooftop solar to subsidize those with rooftop solar, the latter of whom are typically more affluent. So, in addition to raising questions regarding economic inefficiency, NEM raises questions regarding fairness.

The Buy All-Sell All Model

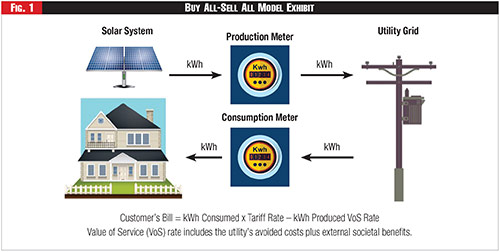

Partly to avoid the negative aspects of NEM, in 2012 Austin Energy, the city's municipal electric utility, introduced a different scheme for compensating customers with rooftop solar. It developed the Buy All-Sell All model, which bills its solar customers for the energy they consume at the rates in their respective retail tariffs and separately buys the solar energy they produce at a Value of Solar (VoS) rate.

The VoS rate is designed to equal the expected costs avoided by the utility and any additional societal benefits gained during the future period when the rate is in effect. Figure 1 illustrates the Buy All-Sell All model.

See Figure 1.

Austin Energy initially set its VoS rate based on a twelve-month forecast of the expected costs avoided and held it constant over that period, then revised it every twelve months based on revised forecasts.

Several other regulatory jurisdictions have adopted the Buy All-Sell All model but have based their VoS rates on forecasts extending out as far as twenty years. These lengthy periods are problematic.

While the error associated with Austin Energy's one-year forecast may be acceptably small, that associated with a twenty-year forecast is not. VoS payments based on lengthy forecasts will either undercompensate or overcompensate solar energy producers for the benefits they provide.

We have seen this movie before. In the 1980s various states interpreted the Public Utilities Regulatory Policy Act (PURPA) as requiring electric utilities to sign long-term contracts with Qualified Facilities. In many cases the contract prices substantially exceeded the utilities' future avoided costs.

Those contracts imposed billions of dollars of additional costs on electricity consumers. In 1998 LCG Consulting, a firm advising the California Energy Commission, estimated that California's three IOUs alone were saddled with PURPA contracts estimated to total about forty billion dollars in above-market costs.

Buying Energy by The Minute

There is a better way to implement the Buy All-Sell All model. Instead of setting VoS rates based on speculative forecasts, why not just pay prices that reflect the actual, contemporaneous value of the solar energy? Why not, effectively, buy the solar energy by the minute?

Adopting a payment scheme that dynamically updates the VoS rate at short intervals would eliminate forecast error. We already have the tools needed to implement this. The internet combined with the two-way communication and data analysis capability available today make it possible to update the VoS energy rate at five-minute intervals by using wholesale market real time energy prices as the starting point.

These VoS rates can be averaged to fifteen-minute, or longer, intervals for use with today's smart meters. Because customers' utility bills are settled ex post, typically on a monthly or bimonthly basis, there would be ample time to do the VoS calculations through batch processing of the wholesale market price data. However, additional ex post payments for natural gas price volatility and avoided capacity costs would need to be made monthly and annually.

A Dynamic VoS Rate

The avoided cost components of a dynamic VoS rate are as follows: avoided energy costs, including distribution system losses (in fifteen-minute intervals); avoided emissions costs (in fifteen-minute intervals); avoided natural gas price volatility (monthly); avoided wholesale generation and transmission capacity costs (annually); and avoided distribution capacity costs (annually).

This publication is not the appropriate venue for delving into the details of the databases and methodologies needed for estimating each of the VoS components but rest assured that it is feasible and practicable to do so.

Looking Ahead

The advantages of compensating rooftop solar through a dynamic Buy All-Sell All model would closely align compensation payments with the value of the benefits received. Furthermore, it would provide a pathway for developing locational spot prices at each connection point on a utility's distribution system, i.e., implementing Distribution Locational Marginal Pricing (DLMP).

DLMP can provide more efficient price signals than any static retail tariff is capable of providing. Thus, DLMP will empower prosumers with local solar and non-solar generation and/or behind-the-meter dispatchable storage. It will also empower retail customers to balance their outlays for electricity against the values they receive from their usage, thereby facilitating efficient price responsive demand.

Ultimately, the electric utility industry will need DLMP to ensure an orderly evolution to the forthcoming smart grid. Surely there are retail regulators willing to try the dynamic Buy All-Sell All model described above on a pilot basis. The results obtained from such pilots could then be used to develop legislative proposals that would enable its full implementation.

Category (Actual):