Directional Headings

Tom Flaherty is a Senior Advisor to companies in the global power and utilities industry for Strategy&.

Paul Nillesen leads the Dutch energy practice for Strategy&.

Mark Coughlin leads PwC’s Australian energy, utilities and mining practice.

The utilities industry is in the midst of reshaping itself, retaining its heritage of reliability, but forging a vastly different future for itself and its stakeholders. Evolving energy policies, rapid technology advances, shifting customer behaviors, and aggressive competitor proliferation are creating an environment where the strategies of the past no longer point the way to the future.

In the August PUF issue we introduced the Global Top 40 (GT40) and provided a snapshot of key drivers framing the future direction of the utilities industry, its financial profile, and shifts in go-to-market models. Here, we further describe the strategies being adopted by these global companies and the positioning moves they are pursuing.

Some global utilities have evolved into entities that dramatically diverge from their legacies. These utilities are introducing new business models, creative approaches to pricing, broadened channels-to-market, and expanded roles with customers. Their view of the future differs dramatically from the past and offers a competitive model unlike any the industry has observed.

Still, the GT40 utilities have maintained a line of sight to the need to expand the business and grow its scale. Specific utilities are seeking to build a distinctive market presence and enhance how to compete through both traditional and non-traditional entities, and they intend to convert this differentiation into discernable market recognition.

Strategy Execution

Utilities across the globe are at different stages of market action through redirected investment and breakthrough innovation. Nonetheless, creating a distinctive strategic market position takes time, and the industry is still early in its evolution.

Utilities are immersed in strategy design for future market success while still defining the most appropriate paths to pursue, and it's not uncommon that customers are not at the forefront of strategy design. Improvements in technology and responding to changes in government policy are still predominant strategic drivers for the GT40 utilities.

Five elements capture how utilities are seeking to position themselves to compete in the future.

Differentiated Strategy: Utility strategies across the industry often read very much alike, given the similarities of the integrated and segmented businesses. In the past, utilities generally tended to move at the same pace and in the same direction regarding strategy definition.

Most utilities are leveraging several common strategies, seeking to increase renewables generation, customer engagement, innovation, modernization, and resiliency. All of these are relevant, but none is truly distinctive.

Strategy separation among the GT40 utilities reflects management's foresight and an ability to act rapidly and aggressively regarding the range of businesses that utilities are entering, the expanding channels to market and the willingness to be early adopters of emerging technologies. These drivers have created a distinct movement and separation among utilities making up the GT40.

Thus far, European utilities are outpacing their North American and Asia-Pacific peers. These utilities view themselves as energy services providers and customer partners with a broad portfolio of offerings and beyond a traditional utility.

Differentiation occurs in how these utilities segment the value chain into addressable elements such as backup supply, energy services, electric transportation, distributed energy services, and behind-the-meter offerings.

European utilities, like Enel, ENGIE and EDF, address customers globally, even as local market factors create a need for tailored delivery solutions. Consequently, they are becoming more innovative in product design and placement, and more agile in shaping go-to-market strategies for development, origination, pricing, and channels.

North American utilities are also engaging in these markets, albeit more narrowly than their global peers. Southern Company, Edison International, National Grid USA, and AEP are pursuing new energy services markets and enhancing their customer value.

Certain Asia-Pacific utilities, such as Hong Kong and China Gas, play in natural resource activities such as natural and liquefied gas, and others have increased their natural gas footprints.

The strategies the GT40 employ are still formative but have common elements woven through them, such as value of the customer and leveraging natural local assets.

Inorganic Growth: The global utilities industry has been consolidating since the early 1990s, when country, province, and state policies dictated functional unbundling and separation of certain assets and customers. This consolidation contracted the number of industry players and the scale of individual utilities, such as in Europe.

The number of electric and gas utilities in North America declined by about sixty-five percent since 1995 from market policy design and the perceived need for market readiness. The number of major European utilities has declined for similar reasons and created even larger national champions.

Utilities pursue inorganic growth for several reasons: a buying opportunity presents itself; the current asset portfolio needs rebalancing; or gaps exist in resources to successfully go to market and satisfy customer expectations. Dominion Energy, Exelon, Fortis, and Duke Energy in North America, Iberdrola in Spain, and Power Assets Holdings in Asia-Pacific have been serial utility acquirers through opportunities that enabled scale and strength.

Beyond simpler and smaller transactions related to supply assets, the utilities sector is acquiring new capabilities to meet emerging customer needs. These capabilities-based strategic moves address new technology offerings, and channel requirements. They occur through a mix of partnering relationships, equity investment, and outright acquisition.

Again, several European utilities are out in front of their North American and Asia-Pacific peers, having committed more financial resources and conducted transactions aimed at building a capabilities portfolio in new energy services. Enel and ENGIE in particular have been aggressive in their pursuit of inorganic growth outside the core utilities business.

In North America, Edison International, Southern Company, and National Grid USA were early movers in acquiring startups and solutions providers that bring capabilities to the energy services space.

A dozen utilities in North America, Asia-Pacific, and Europe have also committed funding to Energy Impact Partners, an energy-focused venture fund that finds and nurtures early-stage technology-based companies to market scale. This has led to investment in emerging disruptors such as Ring, Ecobee, Greenlots, and Tendril. Other members of the GT40 engage through similar private or internal venture funds.

Utilities recognize they cannot organically stand up the capabilities necessary to build these kinds of service and solutions providers within the observed market window. Expansion of these types of inorganic actions will occur simply because the need for technology and digital capabilities is fundamental to future offering portfolios.

Organization Adaptability: Traditional utilities models were designed to meet operating rather than market needs, centering on natural segments such as supply or transmission, rather than on markets, customer types or verticals. These models served a historical need to ensure utilities achieved system reliability and asset performance objectives.

Legacy models are beginning to evolve from asset segments to repurposed positioning, elevated visibility, and market attention. Only a few GT40 utilities have broadly embraced these organizational shifts, but they offer a glimpse into the future of how resources and capabilities may be realigning.

Several fundamental areas are emerging where utilities are realigning resources to meet new market requirements: strategy, innovation, digital, networks, and customers.

Several utilities, among them AGL Energy, EDF, Sempra Energy, Exelon, and ENGIE, include the strategy function as a direct report to the CEO to signal the importance of its role to enterprise growth. The same is true for innovation, where senior officers at Dominion Energy, Xcel Energy, and Enel are responsible for instilling an enterprise view in the operating businesses.

Most utilities are pursuing digitization to recast their positioning from standard information technology deployment to the repurposed deployment of leading-edge technologies in support of operating and customer applications. Utilities such as Exelon, E.ON, and ENGIE exemplify this realignment and have elevated digital to a direct report to the CEO.

European utilities such as RWE (through Innogy) and EDF have shifted their thinking from a customer service-based model to one that emphasizes customer solutions, the customer experience, and the creation and offering of services to meet customer needs. In the U.K., National Grid is exploring plans to build a countrywide network of direct-current fast charging hubs for electric vehicles, bringing it much closer to customers.

Several utilities in North America also are rethinking their legacy segments. Duke Energy and PG&E are emphasizing grid and infrastructure value. AEP, Xcel Energy and CenterPoint Energy elevate the visibility of the customer beyond simple meter-to-cash and contact center roles to solutions delivery.

Asia-Pacific GT40 utilities also elevate the focus on infrastructure modernization (Power Assets Holdings) and customer engagement (AGL Energy) to enhance enterprise visibility and market emphasis.

Structural shifts are just now beginning within the peer group and reinforce the organization model as a valuable element of enhancing go-to-market strategies. Organization evolution and adaptability will likely become key strategic enablers for how utilities succeed and change employee thinking in the future.

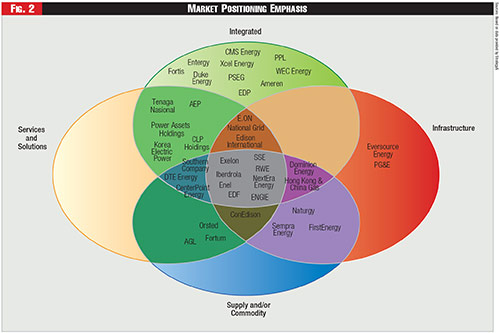

Innovation Advancement: Most of the GT40 utilities have created formal messaging focused on how they intend to become innovative competitors. But there is a chasm between simple statements and achieving their objectives.

Innovation comes in several flavors, and ultimately, is in the eye of the beholder - the customer. Most utilities focus on operational innovation through technology adoption. Others frame the challenge as new revenue creation, a broader value proposition to the customer or clear market positioning.

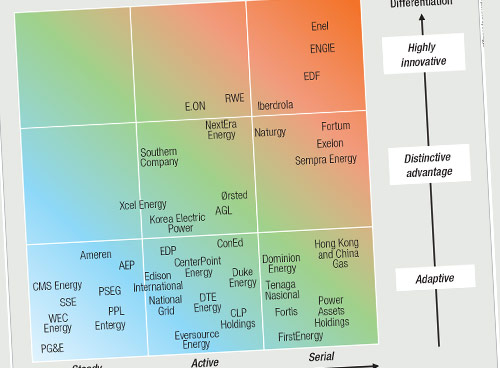

See Figure One.

Innovation is directed at incremental, radical or breakthrough accomplishment, though utilities can pursue all three simultaneously. Achieving a culture of innovation takes time, and utilities often don't have the patience for multi-year education, demonstration, and platform development that typically follow piloting and slow experimentation.

European and North American utilities have been active with innovation programs. These programs have ranged from one-time executive officer-led initiatives intended to galvanize employees to sustained efforts to engage the organization through visible innovation continuity.

Several peers in North America, such as Southern Company, Duke Energy, NextEra Energy, and Exelon, have used formal events to engage employees in ideation and showcase intellectual capacity inherent in their organizations.

In Asia-Pacific, KEPCO is the stand-out innovation player. It has clearly stated objectives for innovation and has commenced investment in an Energy Valley to engage more than a hundred companies

Innovation as a capability is still gaining traction among utilities and will take years to fulfill its promise. Savvy managements are already finding ways to set their companies apart through adoption of various models and techniques to embed innovation within their organizational DNA.

Business Model Agility: The range of business models that pure-play utilities have adopted has historically been narrow, given the nature of how they chose to organize and compete. However, the applicability of new and broader models is increasing as utilities see themselves positioned differently in the future marketplace.

Business model design is slowly advancing as utilities gain experience with new businesses, offerings, channels, and customers. The roles that utilities play in these businesses will define how to play, and the offering mix will extend into non-traditional options for pricing to customers.

As the sector rethinks its where-to-play choices by moving up and down the energy value chain, it is finding there are natural roles for it to fulfill, and consequently there are related economic rents for it to capture.

Pricing options are now expanding to include more negotiated value-for-service and fee-for-service approaches tailored to match roles, activities, outcomes, and risks.

Electric transport provides an opportunity for utilities to redefine how to think about value chain participation and the role a utility should play in advancing the market and supporting customers, particularly at the commercial fleet level.

For instance, the electric transport value chain can be thought of as consisting of nine elements: promotion, financing, infrastructure, fleet services, mobile charging, grid exchange, energy services, aftermarket services, and information management.

Business model options exist for all elements, and pricing models can vary across all value chain elements, excluding promotion. Utilities can create customer, OEM, dealer, and supplier relationships that leverage their infrastructure management, customer knowledge, energy management, and capital raising skills.

Pricing options, such as service contracts, click-through charges, fixed fees, variable prices, leasing rates, and value-based rates, all provide unique forms of value for utilities to capture.

Utility business models historically have been extremely stable. But new market dynamics require creation of new business models - some of which may succeed and some of which undoubtedly will fail. An entrepreneurial mind-set will take time to become universal across the GT40, let alone the broader industry.

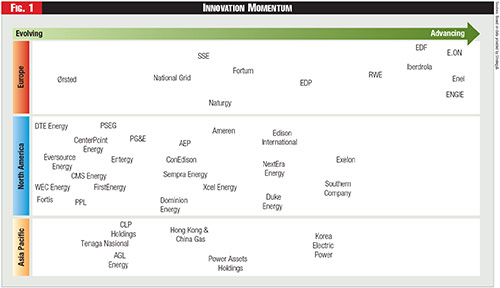

See Figure Two.

Finding the optimal approach to capturing future value sources will necessitate applying innovation to pricing - an area in which utilities applied little imagination in the past. Recognizing that macro-business models (where to play) are complemented at the micro-level (how to win) will make the difference in securing available value.

Strategic Positioning

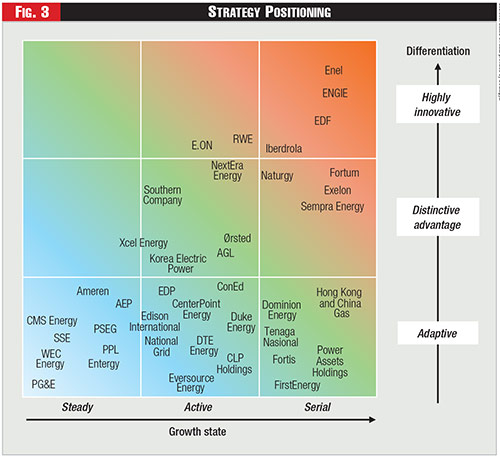

Policy and government pressures in Europe have caused GT40 utilities to undertake strategic repositioning, structural change, or both. As power sourcing shifts from centralized to distributed, more attention is being focused on the network, where batteries and storage are similarly advancing in economics and performance to offer a compatible virtual power plant offering.

With the availability of customer-side technologies such as software, sensors, and controllers, utilities are recognizing that their role in energy intelligence and management is expanding. Similarly, customers are searching for partners to support their energy decision-making, and utilities are stepping into this role more aggressively.

In Europe, some utilities have emphasized the creation of revenue streams from services and solutions businesses. Others, like Iberdrola, invested about seven billion dollars in the U.K. with a focus on innovative operating technology solutions. Ørsted, Fortum, and SSE have emphasized supply and/or traditional network-based models.

Most integrated utilities in North America are forging some form of a services and solutions model. Among infrastructure utilities, CenterPoint Energy, Edison International, Consolidated Edison, and National Grid USA are actively pursuing services and solutions for customers.

Asia-Pacific utilities are generally similar to integrated North American utilities, with a focus on services and solutions. AGL Energy in Australia specifically focuses on supply and commodity, with attention now directed toward services and solutions that can enhance value to customers.

As the macro drivers of policy and technology push utilities away from their heritage business models and customer behavior pulls them toward a services and solutions culture, the GT40 are positioned to leverage unique capabilities to enhance their value as incumbents.

See Figure Three.

Sharper Externalities

The utilities sector has gradually shifted course over the past three decades. Legacy supply models were disrupted, and new retail models emerged. These models broke the stereotype of integrated utilities and created new entrants upstream in power supply and downstream in commodity sales. Customer choice was born, and the economics of supply was the beneficiary of competition.

Now, technology evolution and customer preferences are creating a second era of disruptive models. These new models are characterized by emergence of micro-markets within the sector - storage, rooftop solar, e-mobility - and the awakening of individual customers to the control of energy sources and consumption through advanced technology.

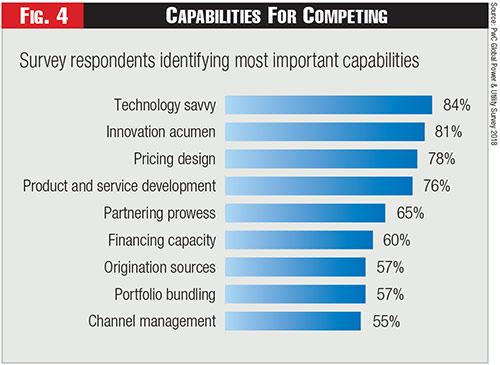

New capabilities will need to be introduced, enhanced, or obtained to support a new market paradigm centered on platforms, services, and solutions. Our recent global survey asked respondents to rank the capabilities believed to be most important to their ability to compete.

See Figure Four.

Respondents identified capabilities they believe core to their success to meet a future built around emerging technologies and sophisticated customers. These capabilities are not prevalent in legacy utilities and are centered on providing go-to-market and business skills essential for success, such as becoming technology-savvy, mastering innovation, and building a product development and pricing engine.

Emerging capital market influences, continued technology advancement, accelerating customer actions, and nontraditional competitive brands are disrupting the global utilities sector. These influences create risks and opportunities for utilities and those that are looking to intrude into traditional utility markets. All these externalities create more instability in traditionally stable markets and require tailored approaches;

Capital Markets: Over the past several years, new market issues have appeared that affect how utilities will respond in the near- and longer-terms. These issues emanate from government fiscal policies and market participants. Costs of investor capital have remained abnormally low as governments have constrained interest rates to encourage economic growth.

A number of utilities in North America, such as Sempra Energy and FirstEnergy, have recently experienced targeted activisms by market funds seeking to influence management's strategies and boost shareholder value. These investors are disruptive by design, and they can radically alter asset bases and management growth plans and actions.

When capital costs increase, so too will investment costs and, ultimately, prices to customers. As activist investors seek to capture greater shareholder value, utilities will need to recognize that future growth is not enabled just by the elegance of a strategy, but through an unrelenting focus on shareholder financial outcomes.

Technology Advancement: GT40 utilities have closely watched the development and introduction of disruptive technologies over the past five years. They understand this technology revolution is not abating and is a natural product of unmet customer needs meeting targeted provider imagination.

The technology landscape is moving from one that is analog, centralized, and standardized to one that is digital, distributed, and personalized. Technologies are rapidly becoming miniaturized and deployed to meet specific needs of the utilities sector and its customer base. These technologies are also becoming more versatile, allowing utilities to deploy them to meet multiple operating requirements.

As these emerging technologies proliferate, utilities will need to become more adept at deployment and configuration. The value of technology adoption will become a particularly critical metric that enables utilities to understand how technology is optimized.

Customer Actions: The global utilities sector finds itself outpaced by both its customers and its competitors. Customers seek new solutions, whether from incumbent providers or other sources, and competitors see market opportunities where traditional providers leave unfulfilled needs.

Customers have shifted from slow market adopters to rapid market initiators and are no longer satisfied with waiting for their traditional utilities to offer the products or services they desire. As customers change - for example, from digital adopters (baby boomers) to digital natives (millennials) - their impatience will increase to demand real-time solutions to their challenges. Traditional responses that do not offer timely satisfaction will be seen as indicators of low innovation.

The GT40 need to understand that customers are becoming aware of solutions options that exist and who best provides them. They are finding this information from open internet sources and a constant barrage of new entrant marketing and social media. The utilities sector will need to consider this accelerated market pace, so its future strategies do not become perishable.

Unnatural Competitors: The competitors of the future are not the same as those the GT40 has come to understand over the past twenty-plus years, and they are not limited by the historical rules of engagement. Some of these new competitors are globally branded, ubiquitous, and highly admired, and they thrive on creating or exploiting new markets.

Established brands such as Shell, BP, Total, and AT&T recognize the scale of the global utilities sector, and other brands such as Nest, Tesla, and Bloom have powerful market recognition and have become active niche players or more in just a few years.

Utilities will need to understand how these players are shaping markets and whether they are market enablers, suppliers, competitors, or partners in the future marketplace.

Directional Headings

The paths the GT40 will take in the coming years will naturally vary and match the policies, requirements, and potential of the localities where they operate. Numerous countries have already paved a road for open markets, technology substitution, and more competition.

Many of the GT40 operate in multiple countries or service territories, so market solutions they offer and opportunities they capture in one location can quickly travel to others where comparable conditions exist. Unique strategic moves will become more common, and broad market presence will become more attractive.

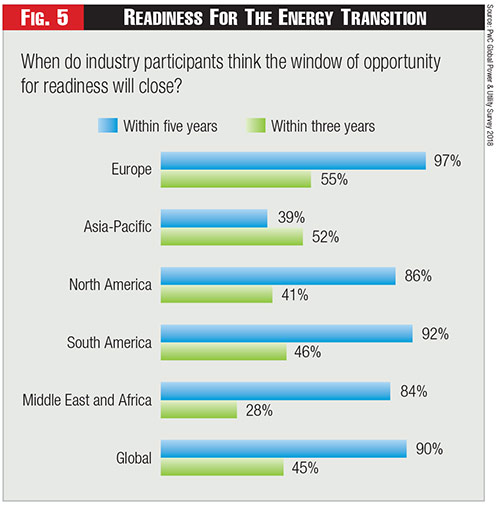

In PwC's global survey, one response in particular stood out regarding the window of opportunity for utilities. Almost half of the respondents believe that this window may last for only three years, yet eighty-two percent are not ready now, and forty-four percent won't be ready in 2020. An opportunity for natural growth could easily be squandered or be too complicated to capitalize upon.

See Figure Five.

The GT40 utilities' future strategies and priorities can be expected to accelerate and evolve toward a few key market opportunities even faster than market observers anticipate, including market shaping, virtual supply, platforms and solutions, home hubs, and value models;

Market Shaping: It will be strategically inadequate to respond passively to markets, as the sector has done historically. Rather, it will be critical to consider how companies such as the FAANGs (Facebook, Apple, Amazon, Netflix and, Google) and their very different approach to creating markets and building enterprise value could be applied in the utilities sector.

To develop great ideas and take them to the commercial market, utilities will have to think more like the FAANGs. They will need to engage in continual market sensing and constant innovation, adopt a commercial mind-set, pursue aggressive branding, and make decisions speedily. Utilities generally possess few of these traits now.

Utilities can develop these capabilities to compete if they visualize future technologies, markets, and customers the same way as the FAANGs. Utilities such as Enel and ENGIE are already acting in this manner in anticipation of potentially competing directly with them.

Virtual Supply: Many utilities recognize generation capacity of the past won't fit a market environment where sustainability is paramount at the political, financial, and social levels. The near-term bridge to new conventional and unconventional supply sources will be storage in combination with renewables as a virtual power plant that fulfills power supply, resiliency, and security needs.

The Big Battery in South Australia combines Tesla battery technology with Neoen wind farm performance to deliver a supply security solution while allowing the asset to invigorate an emerging frequency control market in Australia.

The virtual power plant harnesses the power of distributed generation and creates a new frontier aggressively pursued around the world. Traditional players such as E.ON, AGL Energy, and NextEra Energy all are investing in this space.

These utilities are partnering with other companies including Tesla, Sunverge, and Next Kraftwerke. More utilities will enter this space as storage technologies and required data management solutions become more common and sophisticated.

Platforms and Solutions: For years, the utilities sector considered its network assets to be a mosaic of discrete, but connected equipment, rather than as intelligent, integrated networks. Now the network is being configured to interconnect with multiple devices and equipment that did not previously exist, such as sensors, monitors, and controls.

Although digital asset development is now fundamental to enabling network value, it is not optimized through this activity alone. Optimization is accomplished through deployment and application of software in the network - such as full digitalization.

New suppliers - both traditional OEMs and startups - are bringing their products to the network to enhance its value through equipment monitoring, data extraction and analysis, predictive analytics, and intelligent control. The integration of software into a platform that provides critical technology-based services enables solutions to be created that match customer needs for operating insights.

Digitalization platforms will enable energy brokers, aggregators, demand managers, and price comparison services to proliferate and provide services that customers value. Enel's 2017 acquisition of EnerNoc's demand response business for approximately three hundred million dollars further globalizes a platform for advanced offers for customers, such as flexibility services.

Home Hubs: Behind-the-meter technologies and related services are the next frontier enabled by digitalization, and the home is the next domain to benefit from this evolution. However, this area will not be the domain of the utility alone. Many homes already have the latent capability to start this movement through digital assistants or concierges from companies such as Apple, Amazon, and Google.

E.ON Home is an offering directed at monitoring and controlling energy use and informing consumer decision making. This platform allows utilities to offer services that address fundamental customer needs of comfort, convenience, communication, choice, and control - not just for power and gas, but potentially for telecommunications, entertainment, information, security, domotics, and other areas.

The FAANGs already serve tens of millions of residential customers daily with convenience services that meet basic individual needs, such as information. Beyond the FAANGs, AT&T and Comcast in the U.S., and other global telecom and infotainment companies in Europe and Asia-Pacific, are also engaged in elements of this market space.

The pure size of the global utility marketplace suggests it will be attractive to companies that already know the mass market space. Their ability to apply existing platform ecosystems and customer capture strategies will create formidable competition. This suggests that GT40 utilities need to create attractive partnerships with these competitors soon to secure a viable market position.

Value Models: As GT40 utilities learn to compete in what looks to be a broad products and services marketplace, they will find that many products and services customers need do not fit in a traditional regulated business.

GT40 utilities need to learn where and how to make money in a non-regulated market. These utilities also need to acquire new acumen to price based on a market-back sense of how customers think about value produced.

New competitors are well-versed in non-formulaic pricing, such as non-tariffed or outcomes based. These competitors are experienced in creative pricing approaches and in aligning revenues, costs, and value into tailored pricing models. and their pricing models are already embedded in their business models.

As a practical matter, utilities will not just offer products and services but will bring a portfolio of offerings to customers. This means they will need to become adept at packaging multiple offerings and pricing as a bundle, where beneficial. Risk-adjusted return determination will become a critical skill. This will enable utilities to create business models that link the prices of their offerings to customer value requirements.

Future Actions

This Power Strategies report describes some of the differences in strategic market focus and the range of actions the GT40 utilities have executed to-date. Unsurprisingly, strategic actions pursued have high degrees of similarity, as often happens in the utilities sector. But the degree of strategic shift and relative investment levels vary greatly.

Over the next several years, it is likely that a degree of separation will occur between the most aggressive and innovative GT40 utilities and the rest of their peers, and the degree of separation will likely enable investors to value utilities differently on the basis of their strategies and market accomplishments.

Over the next several years, the GT40 will likely advance their strategic initiatives to include more capabilities-based acquisitions, more partnering with OEMs, platform builders and solutions providers, and more innovation in business model agility.

The GT40 utilities' strategies offer deep insight into where the sector is heading. Although directional headings seem clear, the possibilities of unexpected policy changes, accelerated technology availability and customer-driven market evolution will refine these strategies — sometimes as planned and sometimes quite unexpectedly.

Utilities historically received a multiple premium for the quality of their regulatory environment, management reputation, or financial acumen. Tomorrow, it may be how shareholders perceive the quality of these strategies that enables utilities to monetize their strategies into a higher valuation.

Category (Actual):

Department: