Many Voters Unaware of Costs

Robert Borlick is an energy consultant with more than 40 years of experience related to the electric power industry. He previously held partner-level positions in two international consulting firms, Putnam, Hayes & Bartlett, Inc., and Hagler Bailly, Inc. Recently he has conducted several studies that examine the subsidies that residential rooftop solar receives in various states.

Two years ago, while having lunch with a former Stanford Graduate School of Business classmate, I mentioned how expensive residential rooftop solar was in California. I also stated that residential customers without solar were largely paying for it through their higher electric bills. He stopped me in mid-sentence and blurted out, "Are you telling me that solar energy costs more than conventional energy? How can that be - the sun is free!"

Now, my friend is an educated professional. The fact that he was unaware of how much rooftop solar is costing the state's electricity consumers suggests that the average Californian doesn't have a clue.

Incentives in California

I was doing some research to estimate the incentives produced by the thirty percent federal tax credit when combined with California's net energy metering incentive (NEM). The estimates were for a typical residential customer living in Southern California.

I defined the NEM incentive as the present value of the customer's electric bill savings, less the present value of the costs the utility avoids due to the customer's solar energy production, over the twenty-five-year economic life of the rooftop solar facility.

The results were astounding. They revealed that at the start of 2014 the typical solar customer in Southern California could expect to fully recover the entire investment in about seven years. After which, the solar facility would provide essentially free electricity for at least eighteen more years. This represents an after-tax return on investment of about seventeen percent, with very little risk. I can't think of any low risk investment offering such a lucrative return.

If this sounds too good to be true, it is. Those generous returns are paid for by federal taxpayers through the thirty percent federal tax credit and also by California residential customers that lack rooftop solar but are forced to pay for the NEM incentive through higher electricity prices.

Incentives in Other States

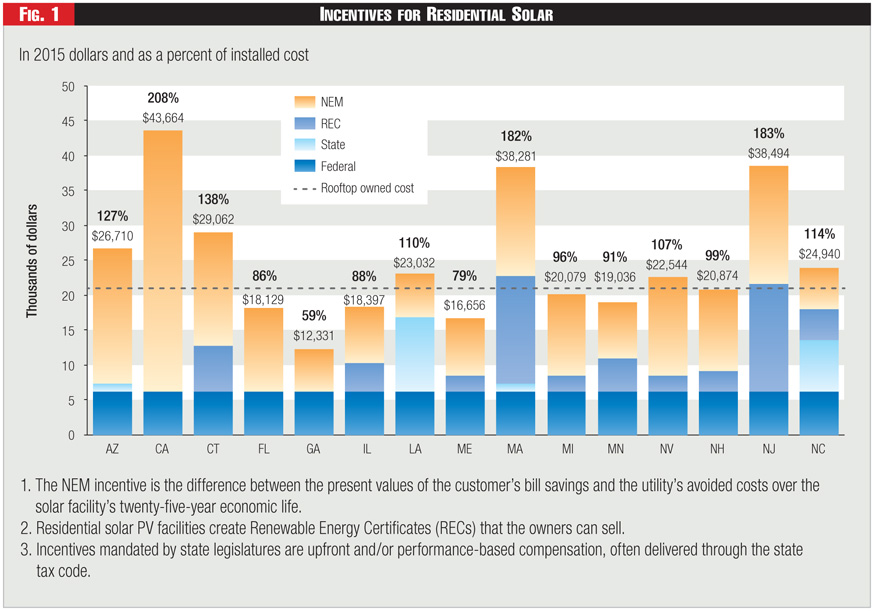

Recently, I did a similar analysis of fourteen other states across the country that incentivized residential rooftop solar in various ways. Again, the results were astounding. They revealed a crazy quilt of state-supported incentive programs, layered one upon another, that produce wildly different levels of total incentives among the states. These state incentives are in addition to the federal tax credit and the NEM incentive.

Figure 1 presents the state-by-state results, displaying the individual component incentives and their totals as a percentage of the homeowner's initial investment of about twenty-one thousand dollars for a typical 6 kW rooftop solar PV facility.

See Figure 1.

As Figure 1 shows, the federal tax credit is $6300 across all states. In sharp contrast, the state incentives, including the NEM incentive, vary substantially.

In 2015 California offered the highest total incentive, $43,664, of which the NEM incentive was $37,364. New Jersey and Massachusetts were not far behind, each offering total incentives of about $38,000, even though their NEM incentives were less than half that of California. This is because both states have set-aside programs for Renewable Energy Certificates (RECs) created by in-state residential solar facilities, which provided more than $15,000 in additional incentives.

A renewable energy resource creates one REC for each megawatt-hour of electricity it produces. RECs have monetary value because states with renewable portfolio standards require electric utilities to own one REC for each kilowatt-hour sold to a retail customer within the state. That must be provided by a renewable resource. Generally, the market values of RECs are determined by the difference between what utilities must pay for renewable energy and what that energy would cost if purchased from nonrenewable resources. However, some states have set-aside programs for RECs produced by small-scale distributed solar resources, which typically create higher prices for these RECs. This includes Connecticut, Illinois, Massachusetts, Minnesota, Nevada, New Jersey, and North Carolina.

For example, New Jersey required each utility to own enough RECs created by in-state solar resources to equal 2.45 percent of the kilowatt-hours the utility sells to New Jersey retail customers during the 2015 energy year. In 2015 this set-aside produced market prices for solar RECs that averaged about $275 per megawatt-hour.

The most important takeaway from Figure 1 is that in over half of the fifteen states the total incentive exceeds (in some cases far exceeds) the homeowner's installation cost of $21,000.

So what is wrong with providing generous incentives for a desirable energy product? Perhaps they are justified by the societal benefits that small-scale rooftop solar provides, most notably by reducing greenhouse gas emissions.

Based on the mid-range estimate of the Social Cost of Carbon (SCC) adopted by the federal government, the societal value of the carbon dioxide emissions avoided by residential rooftop solar generation ranges from about twelve percent of the solar facility's installed cost in Minneapolis to about twenty percent in Phoenix. This suggests that the thirty percent federal tax credit alone is more than enough to compensate residential rooftop solar for avoided carbon dioxide emissions.

But there is a problem with the above argument. The federal Interagency Working Group acknowledged that there is considerable uncertainty regarding the appropriate value of the SCC. This has been subsequently confirmed by an extensive analysis done at the Electric Power Research Institute and another done by the authors of the book "Climate Shock." However, we can finesse this thorny issue because the same carbon dioxide reduction benefits can be obtained from large-scale solar facilities at a significantly lower cost.

Residential Solar PV vs. Large-Scale Solar PV

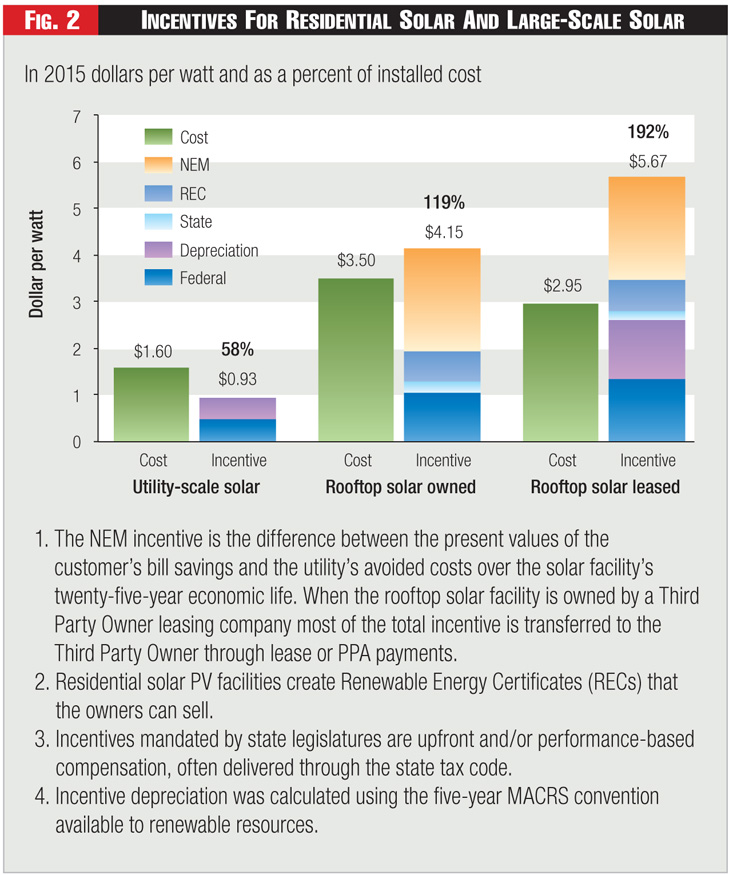

Figure 2 compares the unsubsidized installed cost per kW of a typical, fixed-tilt, 10 MWsolar PV facility with that of the typical 6 kW rooftop solar PV facility under two different ownership arrangements, all of which entered service at the start of 2015. The installed costs and incentives displayed for the customer-owned residential solar facility are simple averages of the costs and incentives for the fifteen states displayed in Figure 1.

See Figure 2.

As Figure 2 shows, at the start of 2015 the unsubsidized installed cost per watt of a large-scale project was about one-half that of a typical customer-owned facility and only slightly more than one-half for a facility leased from a Third Party Owner (TPO) such as SolarCity.

The cost estimates shown in Figure 2 are modeled results. Using a large database of actual reported costs, the Lawrence Berkeley National Laboratory (LBNL) calculated the median installed costs of solar PV facilities that entered service in 2015. The LBNL median values are somewhat higher: $4.10 per watt for residential solar PV and $2.10 per watt for large-scale solar PV. Even so, the LBNL values display a similar 2-to-1 cost advantage for large-scale solar.

A solar facility has no fuel cost and its recurring operation and maintenance costs are relatively small. Consequently, the resource cost of producing electricity is almost entirely proportional to the initial capital investment, exclusive of any upfront incentive rebates. The unsubsidized installed cost data imply that we are throwing away money by selectively promoting an expensive renewable resource when a much cheaper equivalent is readily available.

Figure 2 also compares the per-kW incentives that the large-scale facility receives with a simple average of the per-kW incentives that a typical residential rooftop solar facility receives in the fifteen selected states. Obviously, there is a large disparity in how we selectively incentivize these two different sources of solar energy.

The incentives disparity is even larger when the customer leases the solar facility from a TPO because the TPO can claim the thirty percent federal investment tax credit and five-year accelerated depreciation based on the fair market value (FMV) of the facility, rather than its actual cost.

The U.S. Treasury allows TPOs considerable latitude in choosing the method for assessing FMV. Using the prevalent method, the FMV is an estimate of the present value of the net cash flows the TPO will receive over the life of the long-term contract with the customer, typically twenty years. Thus, the more value the TPO can extract from the homeowner through higher contract prices, the greater the incentive it will receive from federal taxpayers. The result is a double whammy.

Advantage of Residential over Centralized Solar

When presented with the rooftop versus large-scale incentives disparity, rooftop solar advocates will point out that a residential solar PV facility avoids transmission and distribution losses. It also defers investments to increase transmission system capacity; whereas a large-scale solar facility connected to the high voltage transmission system does not.

The marginal energy savings from avoided transmission and distribution losses are relatively small. Furthermore, the NEM incentives shown in Figure 1 already include the effects of avoided distribution losses.

While the savings from deferring transmission system investments are real, they are very difficult to quantify. Certainly, major transmission investment will be needed to accommodate high levels of large-scale solar PV (and wind) resources, such as those that provide thirty percent or more of a power system's energy production.

A recent study by the National Renewable Energy Laboratory (NREL) modeled two such scenarios for the Eastern Interconnect for the year 2026, and concluded that substantial transmission investments would be needed to support such high penetration levels. Thus, it is possible that at some future time the transmission investments avoided by distributed solar could conceivably be enough to overcome the distributed resource's installed cost disadvantage.

Nonetheless, the resource decisions we make today should be based on the known benefits they will produce in the foreseeable future, rather than on speculative benefits they may or may not produce in the distant future.

Regarding distribution investment deferrals, it is impossible to estimate these benefits on a generic basis, because the impact of any particular rooftop solar facility critically depends on where it connects to the distribution system and how much excess feeder capacity exists upstream of that connection. The only way to accurately estimate distribution investment deferrals is to conduct detailed, feeder-by-feeder load flow analyses, as ICF International recommended in a 2014 white paper.

The ICF recommendation is supported by a recent study conducted by the Meridian Energy Policy group. The study examined the effects of rooftop solar using an engineering model that simulated power flows, energy losses, transformer tap changes and new investment needs for a representative distribution system. The authors concluded, "The cost savings are difficult to quantify because many distribution systems are not near their capacity limits."

While I agree that strategically located solar and other types of distributed energy resources can reduce a utility's distribution system investments, the typical residential customer does not install rooftop solar based on its impact on the utility's avoided costs. Replacing the current indiscriminate approach to incentivizing rooftop solar with targeted location-specific incentives could promote economically efficient investments in this technology.

However, the distribution utilities would have to play an active role in determining locational incentives. They have the information needed to assess the value of a distributed energy resource at any specific location on their respective distribution systems. The New York REV proceeding is headed down this path by proposing the establishment of distribution system operators (DSOs) along with the pricing of DER energy. But that's a topic for a separate paper.

It appears highly unlikely that avoided transmission and distribution system investment savings will be sufficient to overcome the two-to-one cost disadvantage that residential solar PV suffers relative to large-scale solar PV in the foreseeable future.

Advocates of small-scale rooftop solar also argue that these facilities provide other societal benefits by avoiding non-greenhouse gas emissions, avoiding fuel price uncertainty, reducing wholesale market electricity prices and creating jobs. However, large-scale solar delivers these same societal benefits at a lower cost.

The jobs creation benefit of small-scale solar is questionable because these projects are seldom compared with other alternatives for jobs creation. Incredibly, some solar advocates claim that the jobs creation benefit of small-scale rooftop solar is higher than that of large-scale solar because the former has higher installation costs.

Put another way, the more money that is spent on wasteful projects the greater will be the jobs creation benefit. Following this logic, a state should simply pay people to dig holes in the ground and then fill them up. Surely states can find better ways to create jobs than by subsidizing inefficient small-scale solar facilities.

State Motives for Promoting Residential Solar

Why do some states promote solar energy policies that appear to be economically wasteful? For whatever reasons, many state legislators and utility regulators favor distributed generation over centralized generation.

As an energy economist, it troubles me when politicians promote economically inefficient programs, but I can accept this fact of life if it reflects the will of their constituents. However, I question whether voters are aware of how much residential solar is costing them. The conversation with my former classmate suggests otherwise. And a statewide survey conducted by the Public Policy Institute of California in 2014 supports this view.

When Californians were asked whether they supported the state law requiring utilities to obtain one-third of their electricity from renewable resources, seventy-nine percent said they did. However, their support plummeted to forty-six percent when asked whether they would be willing to pay higher electricity bills as a result of the law.

This implies that most California residents, and possibly most residents of other states as well, have no idea of how much the incentives for rooftop solar are costing them. If they did, would they still support these incentives?

Regardless of whether they would or would not, the people paying the bills deserve to know what these costs are so they can make enlightened choices when they vote. So please, let's be open and transparent about what these incentives are costing us, and who is footing the bill.

Lead image © Can Stock Photo / pn_photo

Category (Actual):