Future of Rate Design

Ahmad Faruqui is a principal with The Brattle Group. He has worked for more than 140 clients on five continents and authored more than a hundred articles, papers, and books on energy economics.

Clik here to view.

Clik here to view.

Rate design is on the cusp of a revolution, brought on by the introduction of smart digital technologies, the advent of the prosumer generation, and the rollout of smart meters.

From the beginning of the electricity industry in the late nineteenth century, the standard rate for residential and small commercial and industrial customers was a flat volumetric charge, coupled in some cases with a small customer charge. The standard rate for larger commercial and industrial customers was a rate with a non-coincident or coincident demand charge and a flat volumetric charge, coupled with a customer charge. Such rate structures can be classified as Rate Design 1.0.

California's energy crisis in 2001/2002 triggered interest in time-varying rates as a means of connecting retail and wholesale markets. Smart meters began to be deployed in large numbers. At the end of 2016, seventy-one million had been deployed, representing about half of the hundred and fifty million electricity customers in the U.S. Time-varying rates are sometimes coupled with a customer charge, but rarely with a demand charge. These structures can be classified as Rate Design 2.0.

As we approach the third decade of the twenty-first century, we are witnessing the arrival of Rate Design 3.0. This builds on the best features of the previous two generations of rate designs and provides a bridge to a smarter energy future. Rate Design 3.0 brings to fruition the ideas laid out in Professor James Bonbright's seminal work, "Principles of Public Utility Rates."

Bonbright stated, "One standard of reasonable rates can fairly be said to outrank all others in the importance attached to it by experts and public opinion alike - the standard of cost of service, often qualified by the stipulation that the relevant cost is necessary cost or cost reasonably or prudently incurred."

Later, he stated, "The first support for the cost-price standard is concerned with the consumer-rationing function when performed under the principle of consumer sovereignty." He also cited another benefit of the cost-price standard, saying that "An individual with a given income who decides to draw upon the producer, and hence on society, for a supply of public utility services should be made to 'account' for this draft by the surrender of a cost-equivalent opportunity to use his cash income for the purchase of other things."

While discussing the "criteria of a sound rate structure," Bonbright argued that a purely volumetric rate assumes that the total costs of the utility vary directly with the changes in the kilowatt output of energy. He called this "a grossly false assumption" and said that such a rate "violates the most widely accepted canon of fair pricing, the principle of service at cost."

While discussing the Hopkinson rate, which includes a demand charge and a volumetric energy charge, he said that such a "rate distinguishes between the two most important cost functions of an electric-utility system: between those costs that vary with changes in the system's output of energy, and those costs that vary with plant capacity and hence with the maximum demands on the system (and subsystems) that the company must be prepared to meet in planning its construction program."

Bonbright asserted that three-part rates mirrored the structure of utility costs and cited their widespread deployment to medium and large commercial and industrial customers. In support of three-part rates, Bonbright cited an earlier text by the British writer D. J. Bolton, "Engineering Economics," in which he states, "More accurate costing has shown that, on the average, only one-quarter of the total costs of electricity supply are represented by coal [which was the fuel of the day then in England] or items proportional to energy, while three-quarters are represented by fixed costs or items proportional to power."

"If therefore only one rate is to be levied it would appear more logical to charge for power and neglect the energy, were it not for certain practical difficulties of which the following are two. First, the effective power demand on the system made by any particular consumer is extremely difficult to estimate and is very different from the individual maximum demand metered at the consumer's terminals. Second, a purely power tariff would probably lead to a waste of energy to a greater extent than a purely energy tariff leads to waste of power."

Of course, with the arrival of smart meters in the U.S., customer demand at times of system and distribution peak can be accurately recorded. And the choice is no longer a binary one of imposing either a demand-only rate or an energy-only rate. The best rate is going to be a modern three-part rate for all customers.

By providing customers with a price signal that includes components for demand and for time-varying energy consumption, a modern three-part rate would encourage the adoption of behaviors and technologies that smooth out a customer's load profile or match consumption with intermittent supply.

These changes in energy consumption will lead to the more efficient overall use of electricity grid infrastructure and resources. Demand charges allow utilities to signal when and where there are supply or distribution constraints. Similarly, time-varying volumetric rates allow utilities to signal when generation and distribution are least expensive.

These price signals could facilitate a smarter energy grid by encouraging optimum usage when inexpensive renewable energy is available, and lower usage when only expensive, environmentally harmful fossil fuel generation is available.

A more cost-reflective rate can also foster the adoption of emerging energy technologies, like battery storage, programmable appliances, and rooftop solar. Behind-the-meter battery storage could be used to release electricity during hours of high electricity demand and store electricity during hours of low electricity demand.

Load control technologies such as programmable and communicating thermostats, demand limiters, and smart appliances could also help customers better manage their electricity demand. While there is a cost associated with these enabling technologies, they provide levers of change that could help make customers more accepting of the new rate design.

If a customer took service under a three-part rate, the use of battery storage or other demand-reducing technologies would reduce the customer's bill. This reduction in the customer's bill would raise customer satisfaction. Cost-reflective three-part rates can also incentivize customers to smooth their hourly load profiles, even if they have not yet installed enabling technologies.

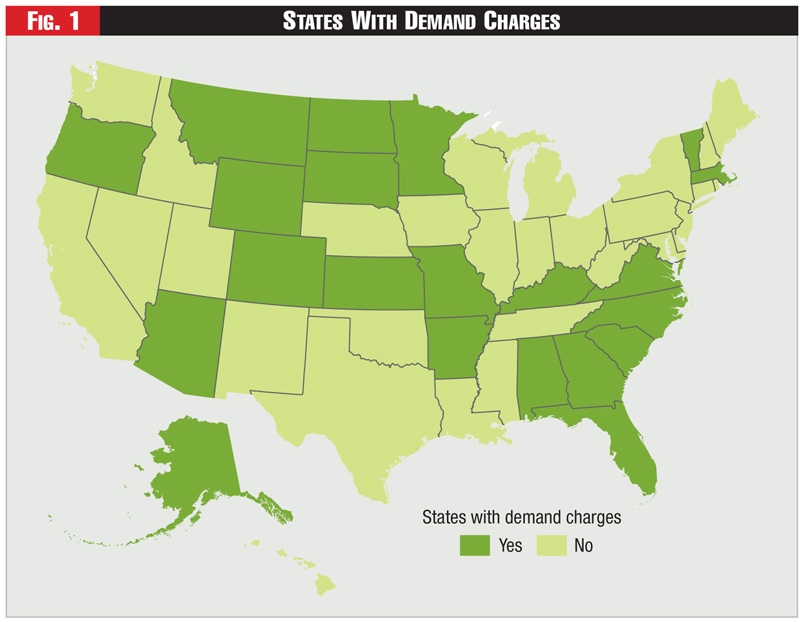

Today, demand charges are ubiquitous for large commercial and industrial customers and fairly common among medium-sized commercial and industrial customers. Increasingly, they are also being offered to residential customers. More than fifty demand charges are being offered by forty-four utilities in twenty-one states to residential customers.

Of these, twenty-three demand charges are being offered by investor-owned utilities; seventeen are coupled with time-varying rates and represent the true expression of Rate Design 3.0. A few of the rates are mandatory. Some are only offered to customers who also own generation resources.

See Figure One.

However, demand charges have evoked an emotional response. They have been called obsolete in a world of digital technologies and considered an impediment to the continuing penetration of distributed energy resources. In December, the California Public Utilities Commission held a workshop in San Francisco to ponder these issues. The discussions continued at the Harvard Electricity Policy Group meeting at West Palm Beach in Florida the following month.

Some experts have opined that in order to move toward a smart energy future, we should do away with demand charges and move toward real-time or hourly pricing of electricity, or some simpler variant of dynamic pricing, such as critical-peak pricing or variable peak pricing.

The argument has been made that a time-varying, energy-only rate (such as Rate Design 2.0) will promote economic efficiency. But the best way to promote economic efficiency is to have the rate structure reflect the cost structure. Forcing the capacity costs of the grid into an energy charge requires the use of either a system-wide or class-wide load factor and is bound to lead to sub-optimal economic efficiency. Furthermore, rate design needs to serve multiple objectives, including equity, bill stability, revenue stability, and customer satisfaction.

While electric power is generated at the power plant, it is the grid which delivers electricity to the customer. When customers connect to the grid, they buy a twenty-four/seven call option on the grid. When they flip the switch, they expect the lights to go on instantly. Whether or not they draw power from the grid, the grid still has to be there, and it has to be paid for by the customers who will draw power from it at any moment.

Customers can pay for the grid through a connection charge, or a non-coincident demand charge, or a fixed charge. But there is no easy way to differentiate fixed charges by customer size. Non-coincident demand charges provide a more feasible option.

While energy costs can be priced dynamically, grid costs are best recovered through demand charges. Thus, demand charges and dynamic prices are not substitutes; they are complements. This is not a theoretical conception. The two case studies below highlight its practicality.

Case studies from Georgia and Illinois

Georgia Power Company's real-time pricing program is often cited as a great example to be emulated by the rest of the nation. And it is indeed an impressive program. Today, the utility has some twenty-three hundred commercial and industrial customers, representing some twenty percent of retail revenues, on hourly real-time pricing.

But an important detail about this rate design is often overlooked. The rate design has two parts to it. In the first part, each customer's so-called baseline usage is billed on a standard embedded tariff, which typically includes a fixed charge and a demand charge.

In the second part, deviations from baseline usage are billed on marginal costs, as determined by five components - with the majority being marginal generating plant operating costs (system lambda).

Also included are marginal transmission capacity costs, marginal generation capacity costs, losses, and a risk recovery factor.

The marginal transmission and generation capacity costs are designed to trigger in approximately three hundred hours and fifty hours respectively, with the other components being included in all hours of the year. Customers with demands greater than five megawatts can qualify for hour-ahead RTP pricing.

Customers with demands greater than two hundred fifty kilowatts are eligible for day-ahead RTP pricing. They have the option of contracting for price protection products to protect themselves from price spikes.

Commonwealth Edison Company in Illinois has sixteen thousand residential customers and nine thousand C&I customers on hourly RTP. Residential customers are on a four-part rate: a fixed charge, a per-kilowatt charge for coincident peak generation capacity (PJM), hourly pricing for energy, and a flat kilowatt-hour price for transmission and distribution.

The utility's commercial and industrial customers are on a five-part rate: a fixed charge for distribution, a non-coincident peak demand charge for distribution, a demand charge for generation capacity, hourly pricing for energy, a flat price per kilowatt-hour for transmission and other elements such as renewable portfolio standards and energy efficiency.

The Elements of Rate Design 3.0

These rate designs will improve on traditional rates, which feature either demand charges with flat energy charges (essentially Rate Design 1.0) or no demand charges with time-varying energy rates (essentially Rate Design 2.0). Rate Design 3.0 will consist of the following elements:

A fixed monthly charge to recover the costs of billing, metering, and customer service. Sometimes this may also include the cost of the line drop from the transformer on the pole to the customer's meter.

A demand charge for recovering grid capacity costs. Sometimes this will be designed to recover the costs of distribution capacity upstream of the customer's meter all the way through circuits and feeders to the substation. Sometimes this will also include the cost of transmission capacity and sometimes also the cost of generation capacity, but the practice is likely to vary by utility. The demand charge could be based on a combination of non-coincident peak and coincident peak concepts, and demand could be measured over a fifteen-minute, thirty-minute or sixty-minute time interval.

A time-varying energy charge for recovering energy costs. In some cases, this may also include the cost of transmission capacity and the cost of generation capacity. This could take one of many forms, such as a simple time-of-use rate, a critical-peak pricing rate, a variable-peak pricing rate or a real-time pricing rate.

The Efficient Pricing Frontier

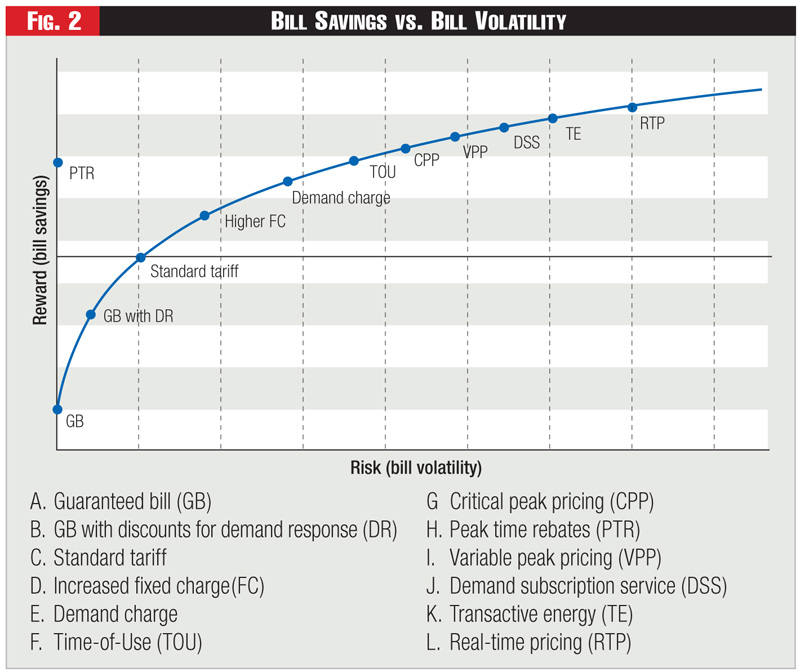

It is self-evident that customers have very diverse needs for products and services. Electricity-enabled services are no exception. At a very high level, there are four types of customers.

Thrifty customers: They are budget-conscious and are willing to use less power to lower their energy bills.

Green customers: They are environmentally conscious and are willing to pay more for green power.

Risk-averse customers: They would like to lock in a constant bill and not worry about what they will be paying at month-end.

Risk-taking customers: They are willing to take risks in order to lower their energy bills.

Not all of these customers are likely to go for Rate Design 3.0. It would make sense to offer rate design choices to customers, since customer satisfaction is a key precept of rate design. However, each rate design that is being offered should recover the costs of serving the customer, to prevent the creation of inter-customer subsidies.

Thus, the guaranteed bill product should factor in the risks associated with volatility in customer loads, volatility in wholesale prices, and the correlation between the two. It should yield an energy bill that is higher than what the customer would have encountered otherwise. The flat rate should be higher than the average price that is implicit in a time of use rate; which in turn should be higher than the average price that is implicit in a variable-peak pricing rate; which in turn should be higher than the average price that is implicit in an hourly real-time pricing rate.

Customers would then have an opportunity to trade off bill savings against bill volatility. Properly designed rates that let customers make this trade-off constitute an efficient pricing frontier. This is shown in Figure Two.

See Figure Two.

Chicago's Richard Thaler was awarded the Nobel Prize in Economics last year. His research brought out the importance of nudging customers toward the best option. Rate Design 3.0 could be made the default rate and some or all of the other designs offered as options.

Making the Transition

There would still be the question of transitioning customers from their current rates, which in most cases will be Rate Design 1 and in some cases Rate Design 2. Several pathways to the future can be envisioned.

In all of these, it would be best to begin by engaging customers through focus groups, to make sure that they understand the rationale for changing rates and to make sure that the terminology used to market the rates will be easy to grasp. If needed, scientifically-designed pilots could be carried in Year 1 to test the concept, gauge customer understanding of the rate, and fine tune the manner in which the rate would be communicated to customers. Then a five-year plan for changing the rates should be developed and marketed to customers through multiple channels, including town hall meetings and social media. This would be followed by moving customers to the default rate. Three plans can be envisioned. In the first one, they could be provided with full bill protection, and then the bill protection could be phased out over a number of years.

In the second one, the parameters of the rate could be changed gradually during a five-year window. In the third one, Rate Design 3.0 could be offered initially as an option. As more customers try it out, and participation rates reach a threshold, it could then be made the default, again with full knowledge of the customers.

But in all of these options, it would be important to avoid surprising the customers.

Category (Actual):

Department:

Clik here to view.