Participation rates, customers’ bills, meaningful choice

Laurence Kirsch is a Senior Consultant with Christensen Associates Energy Consulting. He specializes in economic analyses for the electric utility industry, including studies of wholesale markets, power pool operations, electric power system cost structures, reliability costs, market power, renewable portfolio standards, and greenhouse gas limitations. Mathew Morey is a Senior Consultant with Christensen Associates Energy Consulting. He specializes in renewable energy policy and pricing, transmission congestion management and pricing systems, market monitoring, market design, and incentive regulation.

In the 1990s, deregulation advocates claimed that retail choice would provide significant gains in the forms of lower retail prices and innovative products and services. After twenty years, the empirical evidence strongly suggests that retail choice has delivered only a part of its advertised benefits, and that the lion's share of the benefits attributable to electricity sector restructuring is due to wholesale competition rather than retail competition.

Impetus for Wholesale Electricity Competition

The Public Utility Regulatory Policy Act of 1978, PURPA, was the camel's nose under the tent for wholesale electricity competition. PURPA provided strong incentives for improvements in the efficiency and availability of unregulated generators, which included fossil-fired generators up to eighty megawatts as well as renewable resources. Unlike regulated generators, unregulated generators could keep as pre-tax profit every dollar of cost savings. And unregulated generators could receive revenue only when their plants produced power.

In response to these incentives, during the eighties and early nineties, unregulated gas-fired generators significantly improved their electricity output per unit of fuel input (heat rates) and their outage rates relative to regulated gas-fired generators. This performance, together with the oil and gas price collapse of the mid-eighties, set the stage for the Energy Policy Act of 1992, EPAct.

EPAct provided the starting gun for wholesale electricity competition by allowing a new class of Exempt Wholesale Generators to compete in wholesale markets. The Federal Energy Regulatory Commission, FERC, implemented EPAct through a series of orders starting with Order No. 888 in 1996, which required transmission owners to provide wholesale customers with non-discriminatory access to their transmission networks.

The consequence of EPAct and FERC's subsequent implementation has been that U.S. consumers have saved many billions of dollars per year due to reduced generation costs. These cost reductions occurred because EPAct and its implementation led to substantially greater volumes of cost-reducing trades among wholesale entities, to greater incentives for generator cost reductions, and to better generator performance than would otherwise have occurred.

Impetus for Retail Choice

The political force behind EPAct was provided by industrial electricity consumers who sought direct access to the relatively cheap electricity produced by unregulated generators. While PURPA and EPAct were federal measures that opened up wholesale markets, however, the opening of retail markets was and is under the jurisdiction of the states. Consequently, the implementation of retail choice has been a matter of state policy.

Retail choice allows retail electricity consumers to choose their electrical energy supplier while still obtaining electricity transmission and distribution delivery services from their traditional utility. In principle, retail choice could be a critical complement to wholesale electricity competition because it allows non-utility generators (or their agents) to sell power directly to retail customers. Retail choice could also foster competition and innovation in the delivery of retail services, which could lead to lower customer prices and give customers a wider range of service options.

The industrial customers who supported EPAct also hoped that retail competition would allow them to escape responsibility for paying for high utility costs, such as the legacy costs arising from the nuclear energy challenges of the seventies and eighties. As it turned out, however, the states generally supported utilities' rights to recover the "stranded costs" of their prudently incurred legacy investments. So the industrial customers' hopes were not met in this regard. But the hopes for lower retail electricity prices and wider retail service options endured.

Hope for Lower Retail Electricity Prices

Retail choice might have reduced retail electricity prices if it had allowed customers to escape responsibility for stranded costs. But that did not happen. With such rent-seeking foreclosed, the hope for lower retail prices depended upon retail choice somehow promoting efficiencies in the provision of wholesale or retail electricity services.

With respect to wholesale service efficiencies, it is possible that retail choice might facilitate the development of wholesale competition by expanding the sales opportunities of non-utility generators. Because competition from such generators has spurred technological innovations that improve generator efficiencies and availability, retail choice could be credited with indirectly supporting such innovations, which ultimately reduce retail electricity prices. On the other hand, because wholesale competition increases generators' financial risks and increases the costs of coordinating generation and transmission resources under diverse ownership, retail choice could be charged with indirectly contributing to such costs.

With respect to retail service efficiencies, it is possible that retail choice might encourage retail pricing methods that better match the values that consumers derive from electricity with the costs of producing and delivering electricity. This could occur if customers received better price signals or better curtailment orders than they would receive without retail choice. Although such price signals would increase the variability of retail prices, and although such orders would increase the uncertainty of receiving electricity service, they would generally reduce the average prices paid by customers, and increase the net value of electricity service used by customers.

Hope for Wider Retail Service Options

Retail choice promised to offer customers a larger variety of service options than is offered by utilities, partly by allowing some customers to negotiate terms of service that are tailored to their particular needs. These service options and terms of service could include variations of the following:

- Choice of fuel, so that customers could choose renewable power resources over fossil-fired resources;

- Variability of price over time, so that customers could choose to pay prices that vary with market conditions in the expectation of paying lower prices on average;

- Duration of price guarantee, so that customers can pay a premium to have prices that are known well in advance;

- Firmness of service, so that customers could pay a premium for more reliable service or receive a discount for less reliable service; and

- Billing and payment arrangements, differentiated along dimensions such as frequency and levelization of bills.

Scope of Adoption of Retail Choice

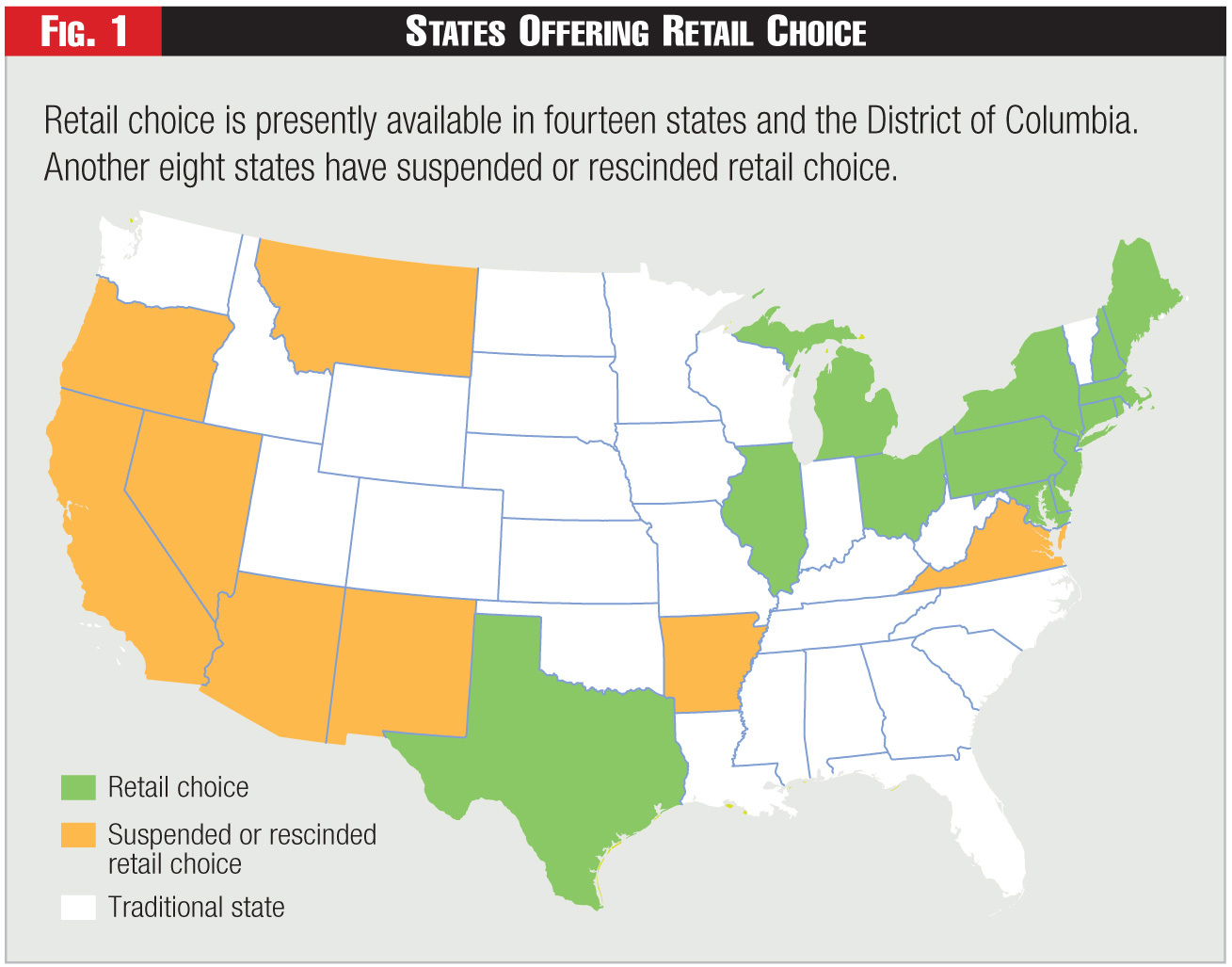

As shown in Figure 1, retail choice is presently available in fourteen states and the District of Columbia. Another eight states have suspended or rescinded retail choice. The states with retail choice tend to be located in regions served by the centralized wholesale markets of Regional Transmission Organizations, so that retail choice is a complement to wholesale electricity competition, thus providing wider sales opportunities for non-utility generators.

In the jurisdictions with retail choice, competitive suppliers serve about half of commercial and industrial load and less than a tenth of residential load.1 The relatively low market share for residential load reflects the transactions costs of switching to competitive suppliers, which are relatively small for large customers and relatively large for small customers.

Various forms of retail choice are also available outside the U.S., in Australia, New Zealand, South Korea, Turkey, and eight member states of the European Union, EU. The experience in the EU indicates that customers are most likely to choose competitive suppliers when competition is vigorous.

Actual Retail Price Impacts of Retail Choice

The many studies of the impacts of retail choice upon retail electricity prices have not achieved consensus. Some studies say retail choice has reduced retail prices, others say it has increased prices, and yet others find no significant impacts. Over the thirteen years from 2003 to 2015, eight studies found significant retail price reductions due to retail choice, seven studies found significant increases due to retail choice, and six studies found no statistically significant price impact of retail choice.

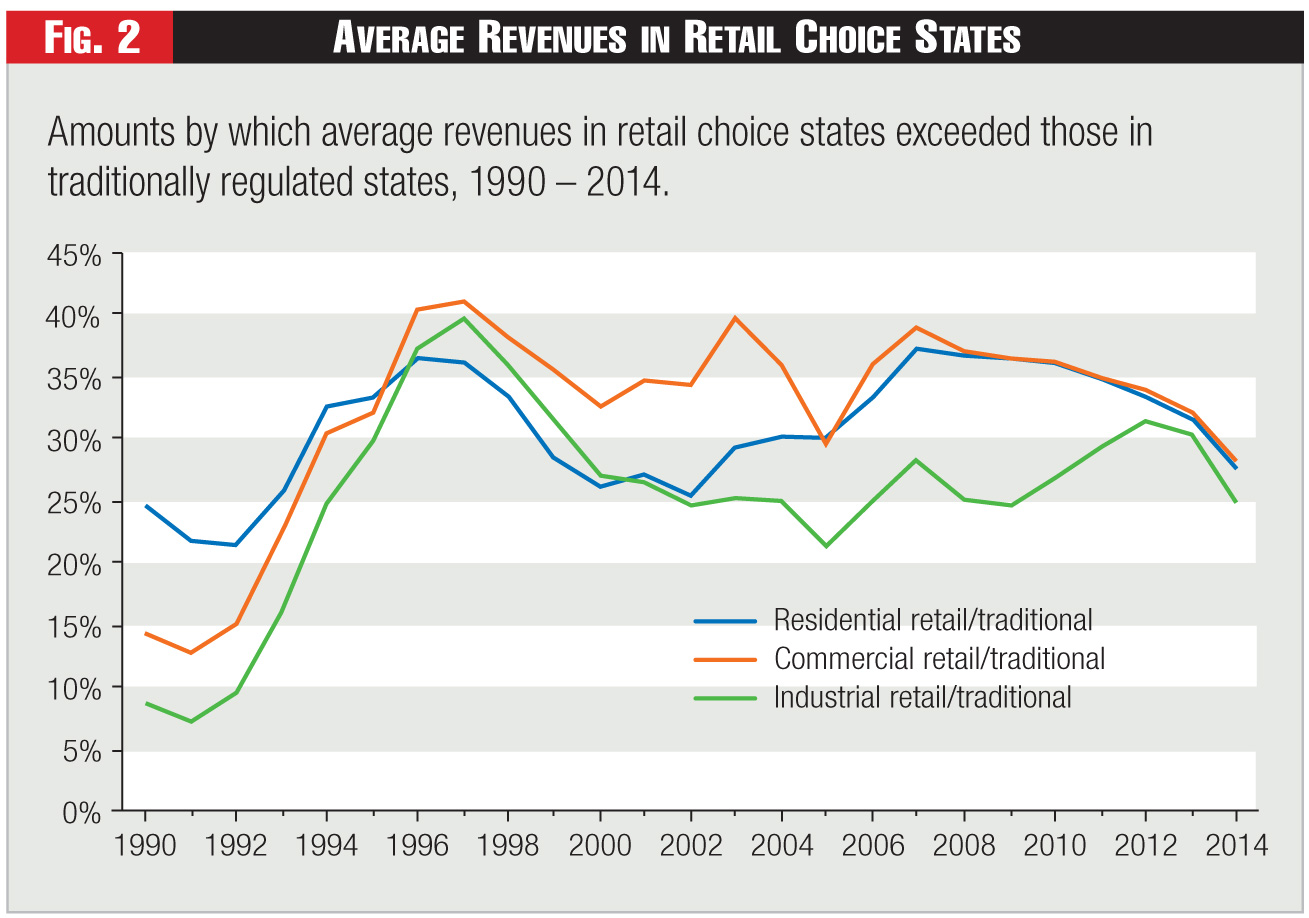

The retail price gaps that motivated retail liberalization in the late nineties still remain near their levels of that time. Figure 2 shows that, for all three major customer segments, price in retail choice states rose relatively rapidly through the early to mid-nineties, before retail choice was implemented, and so motivated the inauguration of retail choice.

The figure also shows that the gap moderated somewhat in the late nineties, and has since fluctuated around the levels of the mid to late nineties. Since 2007, the gap has tended to come down with the price of natural gas, which generally determines electricity prices in retail choice states.

The lack of consensus about the price impacts of retail choice arises from the fact that retail electricity prices depend upon many factors. Some of these factors, like fuel prices and renewable resource mandates and subsidies, have much larger electricity price impacts than does retail choice. Nonetheless, although the impact of retail choice on the overall level of retail electricity prices is small, retail electricity prices in retail choice states appear to have the following characteristics relative to those in other states:

- Retail electricity prices in retail choice states are less stable because retail choice states tend to be associated with wholesale markets in which wholesale electricity prices depend upon current fuel prices and other market factors;

- Retail electricity prices in retail choice states tend to vary by location because of their association with wholesale markets that have locational prices; and

- Retail electricity prices in retail choice states have consistently been higher because, at the outset, retail choice was implemented mainly in higher-cost states that hoped retail choice would help reduce prices. Although the higher-costs states have continued to have higher prices than other states, the price gap has narrowed in recent years due to the substantial drop in natural gas prices.

Furthermore, retail choice has raised some costs or created new costs:

- Retail choice may require new metering that is capable of implementing new retail service offerings;

- Retail choice adds to the complexity and costs of billing procedures, which must allocate customer payments among a larger number of entities;

- Retail choice requires retail suppliers to incur marketing costs that are unnecessary for traditional utilities and that are ultimately recovered from customers;

- Retail choice requires functional unbundling of utilities' generation services and customer services from its other services;

- Retail choice may increase the costs of generation capital by creating significant uncertainties in generation firms' sales and revenues; and

- Retail choice fosters new consumer risks due to the performance problems, and even bankruptcies, of the new unregulated retail service providers. These risks have been very rare for regulated utilities, but not so rare for unregulated retail service providers over the past twenty years. Supplier bankruptcies have tended to occur when suppliers are insufficiently hedged against spot market electricity prices that suddenly jump.

A variety of public policies have undermined the potential efficiency benefits of retail choice. In particular, caps on wholesale and retail electricity prices do not allow the market to operate when electricity prices are scarce, thus significantly increasing the costs of resolving power shortages by undermining generation investment incentives and limiting efficient customer response to shortages. These higher costs are recovered from consumers through hidden charges that ultimately make retail prices higher than they would otherwise be.

There is evidence that retail choice has adversely affected less educated customers, who are more likely than other customers to choose higher-priced alternative energy suppliers. Because of the correlation between education and income, the evidence also indicates that retail choice has adversely affected low-income customers.

In summary, there is no consensus about the price impacts of retail choice, no theory that clearly points to its price impacts being in one direction or another, and inadequate evidence to settle the matter empirically.

Actual Retail Service Options Under Retail Choice

Retail choice appears to have met some of its promises for wider customer service options, while not meeting others:

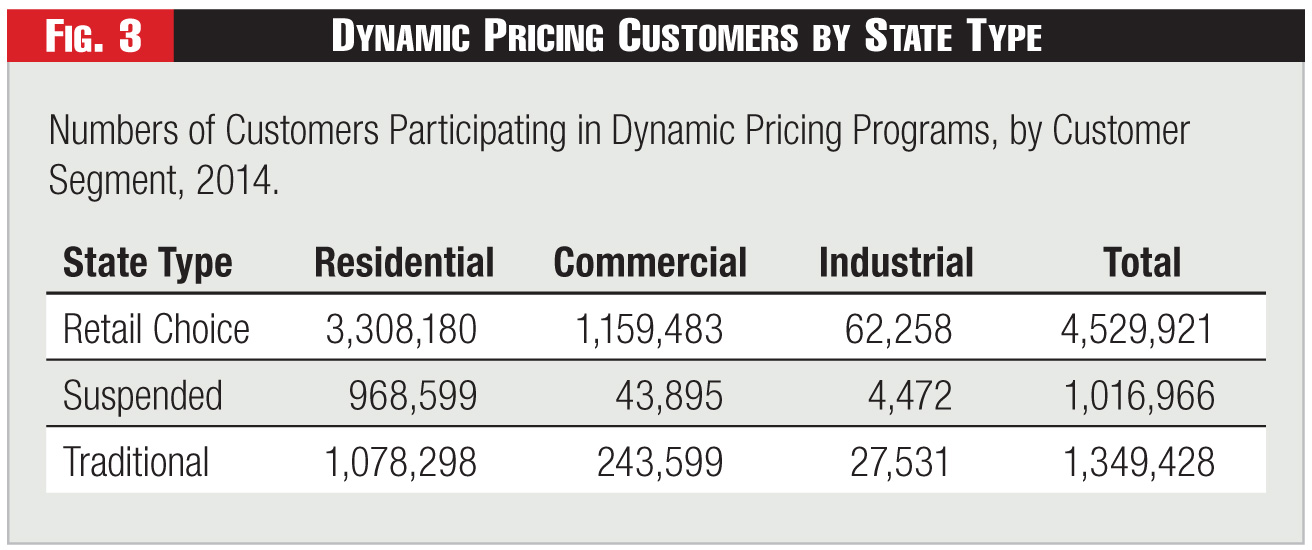

- It has extended customer participation in dynamic pricing programs that reflect power system conditions. These programs should improve the efficient use of power system resources, reduce power production costs, and improve resource adequacy. Figure 3: Numbers of Customers Participating in Dynamic Pricing Programs, by Customer Segment, 2014 shows that retail choice states account for the lion's share of participation in dynamic pricing programs even though these states account for less than half of all retail customers;

- It is not clear whether retail choice promotes demand response in addition to the customer response to dynamic pricing programs. In 2014, for example, retail choice states' demand side programs led to energy reductions of .01 percent for the residential class, .03 percent for the commercial class, and zero percent for the industrial class. The comparable figures for traditionally regulated states were .02 percent, .01 percent and .02 percent, respectively;

Retail choice has not generally promoted smart metering. As of 2014, smart meter penetration in retail choice states was 22.2 percent, as contrasted to 43.6 percent in traditionally regulated states;

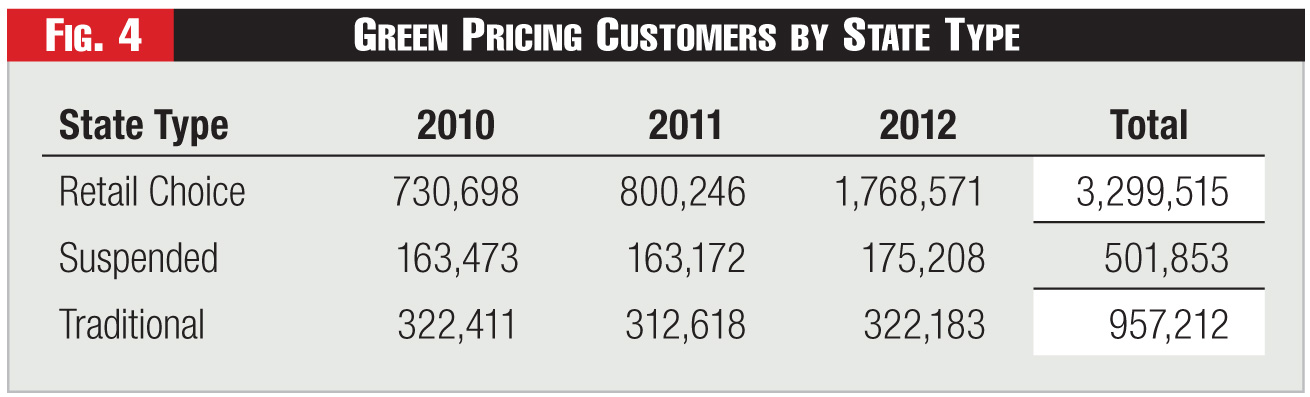

- Retail choice promotes renewable resources, as illustrated by the numbers of green pricing program participants shown in Figure 4. Retail choice thus facilitates customer support of environmentally friendly resources, but also raises resource adequacy issues because of the non-dispatchability of intermittent wind and solar resources; and

- Retail choice has been marred by some fraudulent business behavior that is almost non-existent among traditional utilities, though such behavior is not unusual for a retail services industry.

The experience of the EU indicates that retail choice tends to improve service quality and customer satisfaction.

Conclusions

Retail choice offers benefits to consumers to the extent that it reduces electricity prices or improves electricity service, such as through wider service options. The evidence concerning price reductions is contradictory, so it is difficult to reach a conclusion about retail choice's price impacts. The evidence indicates that retail choice does promote dynamic pricing programs and renewable resources, but is mixed about other dimensions of product choice.

We have a few policy recommendations.

First, retail choice should not be judged according to participation rates but should instead be judged according to whether it reduces customers' bills and improves meaningful customer choice relative to what they would be for traditional utilities. It does not help customers to require that they participate in retail choice programs that fail to offer lower bills or wider choices.

Second, utilities in retail choice states should offer real-time pricing to all customers willing to pay the associated metering and billing costs. This would provide automatic access to wholesale markets for all customers willing to pay the costs of such access. Utilities could also offer derivative services, such as time-of-use and curtailable service rates, to customers who might have different appetites for financial and service risks.

Third, customers who switch to competing energy suppliers should be ineligible to return to a conventional utility tariff. Traditional utilities and their customers should not bear the burden of the costs of standing ready to serve customers who switch to competing suppliers. That burden should be borne by the switching customers themselves, who should be required to accept the traditional utility's real-time pricing rate or some other market-based rate if they choose to return to the traditional utility.

Endnote:

1. These sales shares are based on state migration statistics obtained from state public utility commission websites for the most recently available calendar years.