Integrating controllable demand into real-time, security constrained economic dispatch.

Audrey Zibelman is co-founder and CEO of Viridity Energy, and formerly was chief operating officer at PJM. Chika Nwankpa is a professor and Director of the Center for Electric Power Engineering (CEPE) at Drexel University. Alain Steven is co-founder and executive vice president of strategy at Viridity Energy, and formerly was chief technology officer at PJM. Allen Freifeld is senior vice president of law and public policy at Viridity Energy, and formerly was a commissioner on the Maryland Public Service Commission.

Security constrained economic dispatch (SCED) has long been recognized as the most efficient approach to operating a multi-unit electric grid. However, policy makers also have recognized that improvements to the standard SCED algorithms are possible and would be beneficial. For example, the Energy Policy Act of 2005 directed the FERC to convene a Joint Board to examine SCED in the various regions. The board’s report dated May 24, 2006, contained a number of recommendations for improvements to SCED practices.

The Joint Board defined SCED as “the operation of generation facilities to produce energy at the lowest cost to reliably serve consumers, recognizing any operational limits, of generation and transmission facilities.” As the board noted, “SCED is designed to be an optimization process that takes account of these factors in selecting the generating units to dispatch so that a reliable supply of electricity at the lowest cost possible under the conditions prevailing in each dispatch time interval can be delivered.”

The Joint Board made several recommendations for improvements in SCED, and stated that “The PJM and MISO markets must develop more ways for demand response to participate in the dispatch… Most of the electricity demand enters into the SCED algorithm as non-price responsive must-serve load. It is treated as load that must be served and energy that must be provided regardless of price, taking into account the practical limits of the system. Such large levels of non-price responsive demand provide conditions precedent for volatile spot prices.” The board went on to note that demand response capability increases the efficiency of SCED by increasing dispatch flexibility and resource diversity, and urged the RTOs to improve demand-side participation in dispatch.

On March 15, 2011, the FERC published Order 745. The order provides the financial compensation that is a necessary corollary to the Joint Board’s earlier recommendation. In that order, FERC required grid operators to eliminate the historic discrimination between the pricing of traditional in front of the meter generation and behind the meter demand resources on the grid. The FERC correctly held :

“We find, based on the record here that, when a demand response resource has the capability to balance supply and demand as an alternative to a generation resource, and when dispatching and paying LMP to that demand response resource is shown to be cost-effective as determined by the net benefits test described herein, payment by an RTO or ISO of compensation other than the LMP is unjust and unreasonable. When these conditions are met, we find that payment of LMP to these resources will result in just and reasonable rates for ratepayers. As stated in the NOPR, we believe paying demand response resources the LMP will compensate those resources in a manner that reflects the marginal value of the resource to each RTO and ISO.”

In its Strategic Plan issued in May 2011, the Department of Energy announced a new focus on several aspects of the emerging electric grid of the future. The plan highlights the need to integrate significant amounts of renewable generation in the next few years; develop well-instrumented micro-grids; and develop storage technologies.

All three of these imperatives support a fundamental move to ensure that the U.S. electric grid can meet the needs of the 21st-century marketplace. In the 20th century, economies of scale, regulatory structures, and technical limitations related to data management resulted in a power grid that was characterized by centrally dispatched large scale generation and a relatively passive and uninformed consumer base. Now the demands for energy security, reliability, price competitiveness, environmental protection, and technological change require and allow for a much more decentralized power grid. Moving forward we can expect to have the advantage of an integrated system, in which advancements in load control technologies, distributed renewable and non-renewable generation, and storage all combine to enable power customers to aggressively manage their energy costs and simultaneously support the development of a secure and cleaner grid.

Order 745 reflects the physical reality that the ability of customers to use their own energy resources to curtail and shift energy use on the grid provides a service to the grid operators and markets that must be fairly and equitably compensated at the real-time clearing price of power. The DOE’s announcement reflects a commitment that moving forward there will be increased investment in the assets that provide this essential load flexibility.

In a sense the FERC’s rule and the DOE’s policy initiatives are two legs of a three-legged stool. DOE’s focus will help ensure that the grid is planned and developed on a truly integrated and least-cost basis. The FERC’s rulemaking provides assurance that the markets are operated on a non-discriminatory, economically efficient basis. The third leg of the stool—the physical dispatch of the grid—now can be improved.

Security constrained economic dispatch is the universal approach used by utilities and grid operators to ensure that the dispatch of the integrated power system adheres to sound economic and reliability principles. Historically, this form of dispatch treated voluntary load reduction as one of the last resources used to maintain a reliable grid. Expanding dispatch to include dynamically dispatchable load adheres to traditional dispatch principles and provides significant benefit to utilities and their customers. A change in the basic balance between load and supply is occurring as load becomes a resource.

Integrating Controllable Demand

The basic assumption underlying dispatch in the grid is that load is generally inelastic and the viability of the power system therefore depends on the ability of the grid operator to increase or decrease the output of generators to maintain system balance. Under this paradigm, sound dispatch principles ensure that the dispatcher directs generators to increase or decrease their output based upon their ability to ensure that the frequency is maintained at 60 Hz and there is sufficient transmission capability to deliver power to the load—the “security constrained” portion of SCED. Sound economic principles require that when multiple resources are available to the operator, the least expensive resource available to meet the needs of the system is dispatched first—the “economic dispatch” portion of the rule. In traditional regulated environments, the dispatch order is based on the unit’s marginal cost. In the competitive markets, the dispatch order is based on the bid price offered to the market operator.

In order to perform SCED, grid operators traditionally begin with a day-ahead load forecast. The load forecast is built upon derived experience of similar near-term and historic days. In other words, a mild-temperature weekday load in Philadelphia will look very much like the load pattern of a mild-temperature weekday load one year ago and one week ago. Once the forecast is complete, operators then build a supply profile to meet the demand. The supply forecast is based upon the principle of finding the lowest economic unit or units of generation that are able to physically be delivered to meet the demand. In the RTO markets the dispatch paradigm is based upon the generator’s bid offer, while in regulated markets the generation loading is based on cost of service, and largely reflects the generator’s fuel type and heat rate.

Integrating controllable demand (CD) allows utilities to leverage price elasticity, in contrast to the present situation where demand is treated as relatively inelastic to price. In addition, considering the types of CD available—ranging from building loads, storage systems, and distributed generation—it’s possible to add diversity to this new resource. The following steps allow establishing SCED for controllable demand: 1) Establish a day-ahead (DA) load forecast; 2) Establish a bidding process inclusive of CD, or establish a price for CD; 3) Perform a DA SCED to process and generate market clearing prices (MCP) accordingly on an hourly basis ensuring that demand (load forecast minus CD) equals generation; 4) Post a DA schedule highlighting effective stacking of resources to meet actual demand; and 5) On the following day, similar to what was stated earlier, perform a real time SCED—inclusive of both traditional and CD resources—to process and generate adjustments to the DA schedule based on ongoing corrections to the forecast, with the focus being to achieve a balance that results in lowest-cost or lowest-price dispatch.

To integrate actual load into the system, the grid operator supplements the day-ahead SCED plan with real time conditions. Generators are required to increase or decrease their output for real time load and operating conditions to ensure that supply and demand remain in balance. In real time, SCED principles are also deployed to ensure that the resource that is used to achieve the balance results in lowest-cost or lowest-price dispatch.

Neither of these paradigms typically include variable load as a resource that can be modified based upon price and system availability. This approach makes sense if load is assumed to be relatively inelastic. Under the traditional dispatch mindset, load is considered the last resource that will be used to reduce system peaks, because load curtailment is considered onerous and thus should be used sparingly. As a result of this approach, the ability to use load shifting and curtailment is limited to peak shaving, and even then, in most instances it occurs only on the highest volume days or when the grid approaches critical conditions.

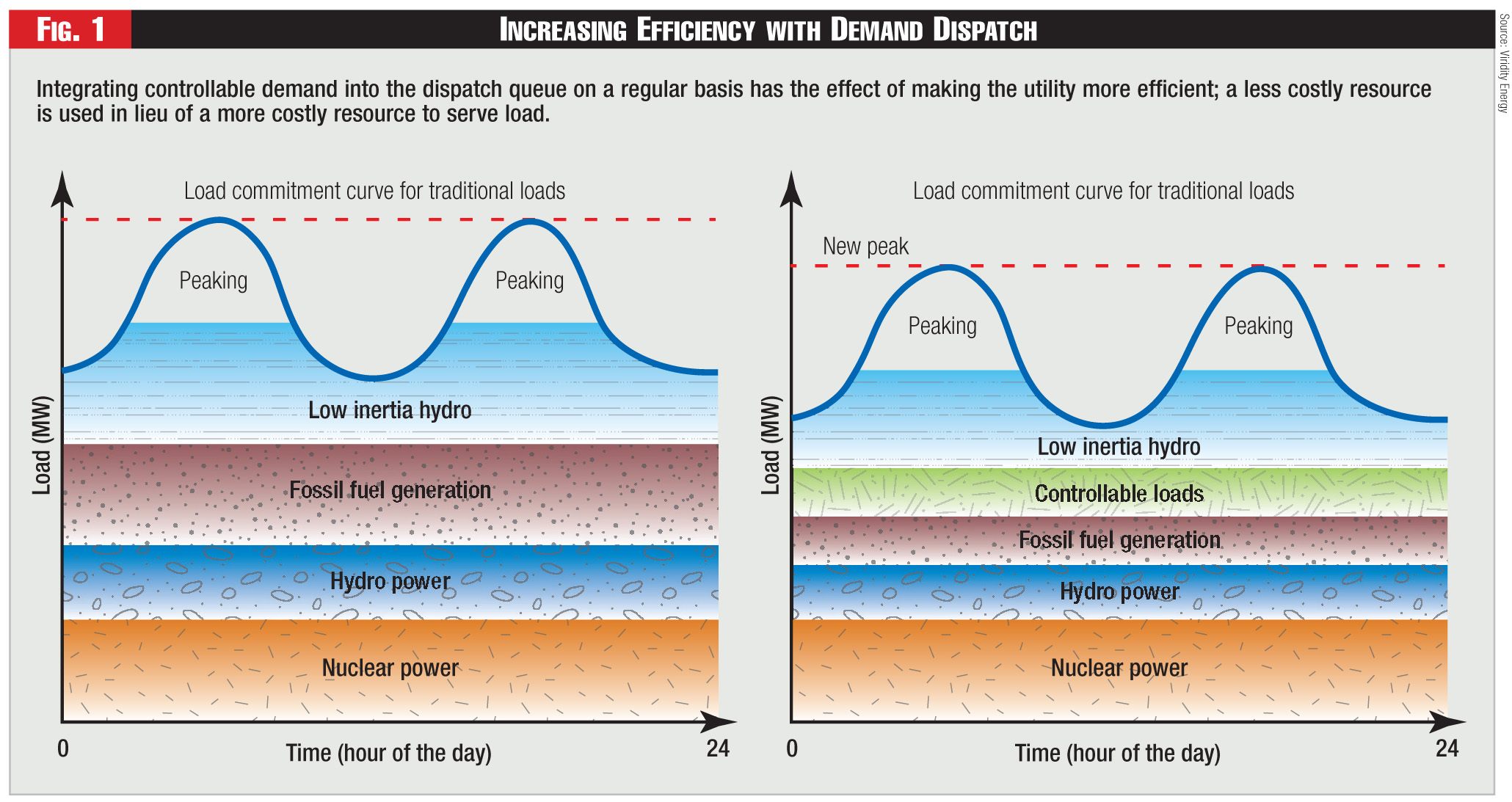

Including dynamic load in the forecast and operations ensures that SCED achieves its economic and reliability objectives. (See Figure 1.) Integrating controllable demand into the dispatch queue on a regular basis has the effect of making the utility more efficient; a less costly resource is used in lieu of a more costly resource to serve load. And the more costly resource is now available to serve other loads, such as wholesale customers. The effect can be lower prices for native load and increased earnings for the utility—the typical result of genuine efficiency improvements.

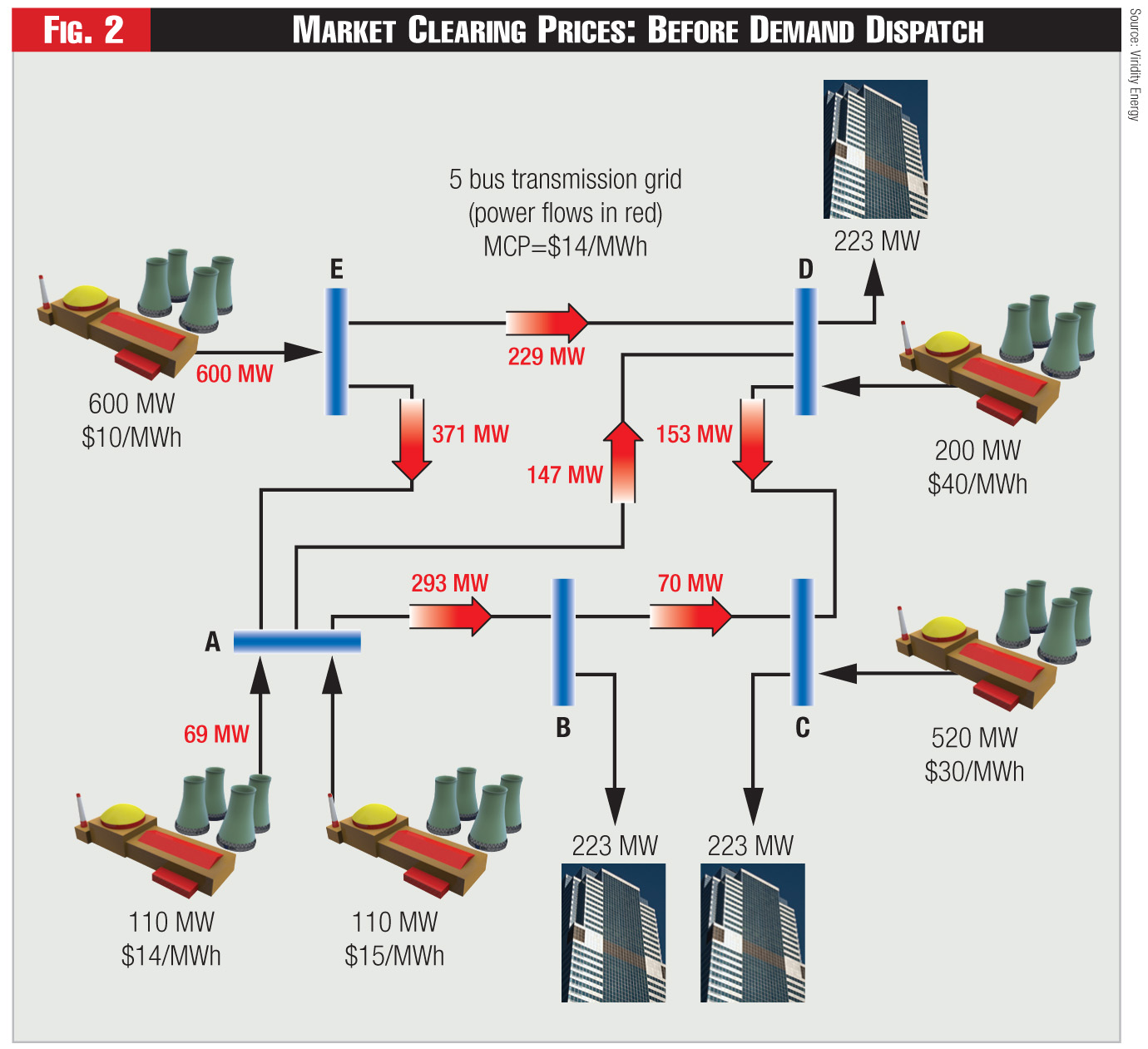

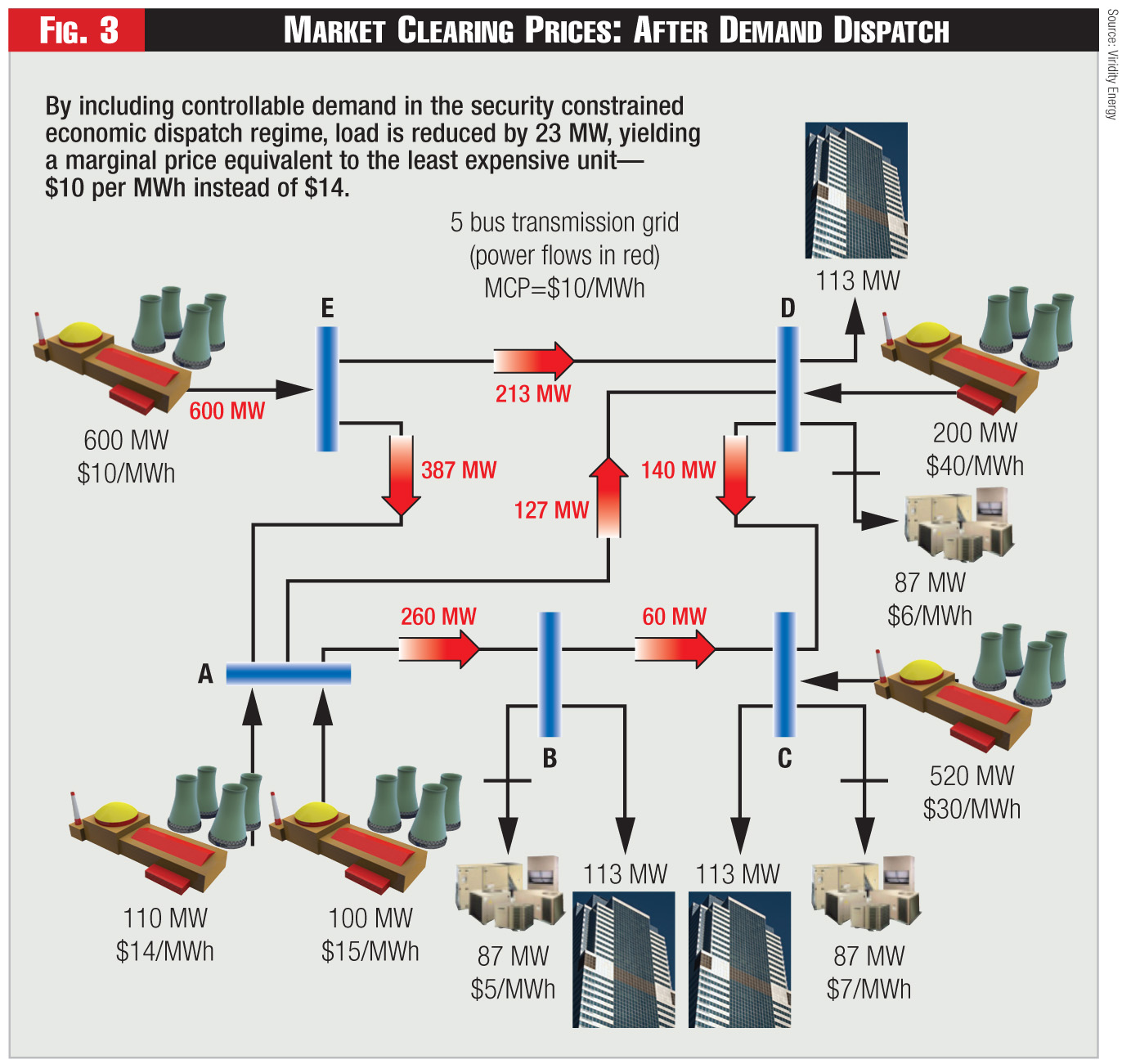

The process of integrating controllable demand into the dispatch queue in a traditional integrated utility regime requires assigning a cost to the controllable load—in effect the payment required to the curtailing customer. In a competitive market, the demand resource submits a bid, and if it clears, it receives the clearing price. In both cases, the controllable load then fits into the dispatch queue at the appropriate place, dispatched after lower-priced generating units but before more-expensive units. Figure 2 illustrates a scenario where the generating units are serving an uncontrollable load amount of 669 MW. In this situation, only two of the four available sources are actually serving the load, making the marginal price equivalent to the second-least expensive unit—the units attached at bus A. But a different picture is portrayed in Figure 3, when demand injections—at buses B, C and D—are broken up into controllable and uncontrollable loads. The controllable amount of load has been lowered by 23 MW in each case to achieve a new marginal price equivalent to the least expensive unit—in this case, the unit attached to bus E.

Regulation and Controllable Demand

Including dispatchable load provides benefits in both traditional regulated and market environments. As noted, in a regulated, cost-based dispatch environment, controllable load can displace generating units with higher variable costs, such as fuel costs. In competitive markets, controllable load is dispatched only when it clears a competitive auction. Thus, it displaces a generating unit that bid a higher price. In a regulated environment, the benefit appears as a lower fuel clause component of the end user’s bill. In a competitive market, the benefit appears as a lower clearing price.

Other benefits associated with increased integration of controllable load include reduced operating expenses, reduced reserve requirements, improved reliability, and better integration of renewables as quick-responding load can be used to firm up intermittent generation resources.

Demand dispatch can be deployed for multiple utility purposes and under alternative regulatory scenarios. The use of CD in this fashion can defer or eliminate costly capital expenditures associated with substation expansion and stressed distribution feeders. And the integration of predictable, reliable CD into the utility dispatch queue reduces fuel costs and opens up new revenue opportunities for customers and utilities.

Such program can be administered as a utility program under PUC approved tariffs, or it can be delivered via an unregulated subsidiary. The choice is, of course, heavily dependent upon the regulatory environment in a particular jurisdiction. In either scenario, there are benefits to the utility, its general body of ratepayers, and customers provide the CD.

An active load management program provides many distinct advantages to regulated utilities. It leads to better regulatory relationships as more utility regulatory commissions embrace customer load control and efficiency initiatives. It assists in meeting various regulatory mandates, and it can ease utility capital expenditure constraints by providing an operating margin with little or no capital requirements. Finally, as electric vehicles and microgrids are deployed, experience in managing controlled load will be quite valuable to utilities.

Controllable demand is directly analogous to an energy and ancillary resource on the utility’s system. Rather than increase generation, the utility can use predicted and controlled demand reductions to meet other load requirements on the system and redirect traditional resources to the wholesale market. In addition, forms of CD can be used to provide operating reserves, regulation services, and even reactive power on the grid. CD by definition is price responsive and is predicated on the customer’s desire to change consumption on the grid based on its individual economics, energy requirements and control capability.

As in the case of other forms of energy, CD is an offset to fuel and operating costs the utility would otherwise incur to meet retail customer demand. CD also can be used to offset transmission operating expenses, such as line losses, reactive power requirements, and wheeling charges where relevant.

Several approaches are available to utilities to partner with customers in providing these services in ways that benefit the utility, as well as the CD customers and other retail customers. In all of these approaches, the utility’s demand charges and any interruptible rate programs can be treated separately in retail rates. The payments made to customers will be recovered in the utility’s fuel charges and allocated to other customers. Since this is based on hourly energy costs or wholesale prices, real time retail pricing isn’t necessary. In addition, participating customers must be able to schedule demand reductions on a day-ahead and real time basis so that it can be used as virtual power in the utility’s generator dispatch program, and they also must be able to demonstrate that the load was price responsive—i.e., not a permanent reduction.

Policy makers can choose from among three primary approaches to implementing controllable demand in wholesale markets.

• Direct Market Access: Under this approach, the utility offers customers direct access to the wholesale market.Customers get the benefit of the prevailing wholesale prices and also avoid the fuel and energy charges associated with reduced consumption from the utility. The utility and its other customers benefit from the ability to use existing generation to gain revenues in the wholesale market. They also benefit from reductions in losses and other charges associated with the reduced need to meet the customer’s dynamic consumption.

The advantage to this approach is that it’s simple to administer and doesn’t require any real settlements between the utility and CD customers. It also provides the greatest incentive for customers to invest in the control systems and resources that allow them to provide CD. A potential criticism of this approach is that it gives CD customers the benefit of system average costs on the supply side and wholesale pricing on the sell side, and thereby creates a form of subsidy by the utility’s other customers.

• Wholesale Revenue Sharing: A variation on direct market access, wholesale revenue sharing allows the utility and CD customers share a portion of the wholesale revenues based upon a tariff or other pre-negotiated mechanism. This approach provides the wholesale market signal to CD customers but shares the benefit among the utility and its other customers. The revenue share would reflect the administrative costs the utility incurs for the program and to cover other costs associated with backing up the CD customer’s resources in the case of non-performance. This revenue sharing could be in lieu of any imbalance charges if the customer misses its forecast demand reduction, and addresses the subsidy concerns in the first variation.

• Cost-Based Dispatch: An alternative mechanism is for the utility to pay the customer its system average dispatch costs. Under this mechanism the utility would be required to publish its system average costs so customers could determine whether it’s more economic to sell or buy energy. Alternatively the utility could have a tariffed price to beat based upon its system average costs, which could include any operational expenses and losses that are avoided when a customer uses its internal resources, as well as the reliability benefits associated with the ability to use load as a dispatchable resource.

Reliability and Third-Party Aggregators

The role of the aggregator is to work with the utility and customers to identify the controllable demand potential, and to provide scheduling and any settlement services. The aggregator can function as a common platform that the utility offers to customers interested in participating, and the costs of implementation can be treated as an expense to be recovered in a fuel clause or under an approved demand response program. Working with such a common platform and knowledge, the utility increases the value of controllable demand. Essentially the participating customers create a pool of load-based energy assets within the utility’s distribution grid. On an aggregate form these assets can be dispatched to provide maximum economic and reliability value, because the aggregator has more transparency into both the utility’s needs and individual customer capabilities, and can coordinate a unified dispatch with the utility. The costs of administering this program can also be charged back to the participating customers and thereby avoid any imposition of costs on non-participating customers.

Making this approach work requires a distributed energy management system that integrates distributed energy resources—generation, storage and load management—onto the grid. The system must allow for full integration of curtailable load into ISO day ahead and real time energy, capacity and ancillary services markets, and its functionality and capabilities must mirror those of an energy management system used to forecast and control generation on complex and integrated power systems, such as the RTOs. Such a system includes robust forecasting of load, generation, and prices; unit commitment; and resource optimization capabilities. Additionally, a CD management system incorporates measurement, validation and reporting functions, as well as capabilities for localized optimization, to help distribution operators manage constraints at feeders, substations, and other equipment. Deployment of the system will allow a utility to accomplish the principal elements for successful distributed resource integration.

Controllable load can be used by both customers and their utilities to maximize the capabilities of controllable load and distributed resources—particularly environmentally benign resources—to reduce load on the grid. Unlike traditional demand response systems, bid-based dispatch provides customers with greater certainty that they have the capability to commit to specified reductions of load on the grid, and validates for the utility that the reductions occurred. Customers and the utility can use this capability to participate in wholesale capacity, energy, and ancillary services markets, thereby increasing the value of distributed load control and resources to them. And bid-based dispatch can be used to dynamically schedule load reductions or distributed resources into the grid as reliable resources that can be used to address grid-wide or local reliability and security concerns.

Endnotes:

1. Report on Security Constrained Economic Dispatch By The Joint Board for the PJM/MISO Region Submitted to the Federal Energy Regulatory Commission (Docket No. AD-05-13, May 24, 2006).

2. Joint Board at 5.

3. Id. at 46-7.

4. FERC Order 745, ¶47.

5. DOE Strategic Plan, May 2011, at. 24.

6. Dynamically dispatchable load refers to the portion of power load that is flexible and can voluntary be decreased or increased in real time. This can thought of as virtual generation.

7. This obviously would make sense only in those situations where a utility can access a price-based wholesale market.

Category (Actual):